Throne

-

Content Count

11 -

Joined

-

Last visited

Posts posted by Throne

-

-

32 minutes ago, peterB said:none of your add/cover/sell scripts contain a stop loss order so no wonder you do not have any stop set after using them

Okay so how do i fix the scripts to update my original stop with the initial order?

-

Guys I cant for the life of me figure out how to scale in and out with these scripts and make my original stop update with adds or sells correctly. I will post my scripts and hopefully someone can tell me what Im missing.

50% short

StopPrice=Price+0.01;DefShare=BP*0.97;Share=DefShare*0.25*Price*0.025;Price=Price-Bid+0.01;SShare=Share/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=LIMIT;Price=bid-0.03;TIF=DAY+;SELL=Send;DefShare=400;TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice+0.3 ACT:BUY STOPPRICE:StopPrice QTY:Pos TIF:DAY+;50% Long

StopPrice=Price-0.01;DefShare=BP*0.97;Share=DefShare*0.25*Price*0.025;Price=Ask-Price+0.01;SShare=Share/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=LIMIT;Price= Ask+0.03;TIF=DAY+;BUY=Send;DefShare=400;TriggerOrder=RT:STOP STOPTYPE:MARKET PX:StopPrice-0.3 ACT:SELL STOPPRICE:StopPrice QTY:Pos TIF:DAY+;25% Add

CXL ALLSYMB;DefShare=BP*0.97;Share=Pos;SShare=Share *0.25;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=LIMIT;Price=bid-0.05;TIF=DAY+; SELL=Send;DefShare=400;25% Cover

CXL ALLSYMB;Route=LIMIT;Share=Pos*0.25;Price=Ask+0.03;TIF=DAY+;BUY=Send25% Sell

CXL ALLSYMB;Route=LIMIT;Share=Pos*0.25;Price=Bid-0.03;TIF=DAY+;SELL=SendOnce again all Im needing is to have the original stop update the shares correctly as I scale in and out of the position.

-

3 hours ago, peterB said:your hotbutton seems to be a mess:

How do i fix it because that is what shows in the sheet for my hotkeys.

-

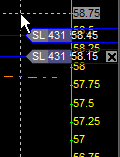

Can someone tell me why my stop looks like this:

I mean it works but why are there two.

Here is my my hotbutton config:

StopPrice=Price+0.01;DefShare=BP*0.97;Share=DefShare*0.25*Price*0.00749999999999999;Price=Price-Bid+0.01;SShare=Share/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=LIMIT;Price=bid-0.05;TIF=DAY;SELL=Send;DefShare=400;TriggerOrder=RT:STOP STOPTYPE:LIMIT PX:StopPrice+0.3 ACT:BUY STOPPRICE:StopPrice QTY:Pos TIF:DAY+;

Also what do I need to do to make my stop update based on scaling in and out?

Here is my scale in and out configs:

Short

DefShare=BP*0.97;Share=Pos;SShare=Share *0.25;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=LIMIT;Price=bid-0.05;TIF=DAY; SELL=Send;DefShare=400;

-

13 hours ago, peterB said:@danpadcas you click on the chart where you want your stop loss to be and click the hotkey. done

@Throne it really depends on what you want to do. you just need to know what you are doing. if you like to open small then add, you could do it by using the same hotkey multiple times or use the free roll hotkey. really depends on where is your target and the overall situation. for scaling out you use the partial hotkeys with or without moving the stop loss.

@peterB Thanks for responding so quickly. Let me play in demo a few days and report back.

-

Can anyone explain how to properly use the scale in and scale out scripts. I like to scale it and out of my positions but Im not quite sure how to effectively do it using the scripts.

-

22 minutes ago, Justin said:Great. Note that you can change the Route to Market and Price to Bid, for whatever your preference is on getting out of a position.

FYI Justin this is the script I was trying to use out of the spreadsheet, Im with CMEG.

Scale- In POS % 50% Long:

DefShare=BP*0.97;Share=Pos;SShare=Share *0.5;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=LIMIT;Price= Ask+0.05;TIF=DAY; BUY=Send;DefShare=400;

Scale-Out POS % 50% SHort:

Route=LIMIT;Share=Pos*0.5;Price=Ask+0.05;TIF=DAY;BUY=Send -

16 minutes ago, Justin said:So you're asking If you are long and want to scale out 50% without touching your Stop Loss?

That could be something like this:

Route=LIMIT;Share=Pos*0.5;Price=Bid-0.05;TIF=DAY+;SELL=Send;

Short would be:

Route=LIMIT;Share=Pos*0.5;Price=Ask+0.05;TIF=DAY+;BUY=Send

THanks Justin I try these and see if I can get them working.

-

1

1

-

-

3 hours ago, Justin said:You technically don't need to cancel and reset the stop loss, but if you don't and the price goes against you, you'll suddenly be in a flipped position. This scenario will happen:

You are 100 shares long at $15You have a stop loss sell order set for 100 shares at $14.90You partial 50 shares at $15.50It goes back to your stop loss, and you're suddenly 50 shares short.This will cancel your stop loss and reset it to breakeven with the correct remaining shares:CXL ALLSYMB;Route=Stop;Price=AvgCost;StopType=MARKET;STOPPRICE=AvgCost;StopPrice=Round2;Share=Pos;TIF=DAY+;Send=Reverse;Thanks for responding Justin, do you know know the scaling hotkeys should work with the stops? Im tracking on what you said with the flipped positions, thanks. I just would like to scale in and out if without taking the stop out if i can.

-

Guys the hotkeys are working flawless for me, but I got a silly question when Im using the scaling in and out hotkeys do I need to cancel the the stop lost in order for them to take? I cant get the scale out hotkey specifically to work properly.

DAS - Dynamically Calculate Shares on %Risk or $Risk - Hot Key + Configuration, Updated 9/10/19, v2.1

in DAS Trader Pro Tips and Tricks

Posted · Edited by Throne

Ok try adding what you suggested. You mention if you want to add more you just do it again, does that mean you are literally clicking in another stop lost and basically having 2 or more stop losses on the chart or how is your script handling the stops?

I scale in and out of my positions most time to help with either losses or taking profits to early. So I do what I called "starters" which could be like 25% or 50% of my total size for the trade and add or subtract as the trade goes on. But the biggest thing is i never want my initial stop to change or go away until i manually clear it I just want it to update with total shares.