.jpg.4a33c107d3df216c89adff7860287949.jpg)

Glenn Budde

-

Content Count

315 -

Joined

-

Last visited

-

Days Won

20

Posts posted by Glenn Budde

-

-

3-23 to 3-27-20

What I did bad this week:

Technical Errors: Wrong hotkey once

Trade management:

Jumped the gun in the early market

Over-trading: Tried several scalps at end of day that were not part of my playbook and or trades that were not in playbook on 4 of the days

What I did good this week:

Respected my in trade and daily stops.

Took most trades on all of the days that I was calling out

Only took PB#3 or PB#7 live

Feeling more confidant in my PB#s 3 and 7

Reading the tape well on focused days

Adjusted in-trade trading plan for the current choppy market taking more partials and scalping more. Staying in control of my emotions for most of my trades

Changes to be made this upcoming week:

Work on playbook trades that I may need to scalp when Tape is slow or not doing what I anticipate

Rules to stick by this upcoming Week:

1. After I call it a day by either MAX Loss, Profit Target or what I am comfortable with, only use the rest of the day in SIM unless it is an A+ setup then only give back what is in my plan

2. In-Trade and Daily Stops

3. Do Not chase or revenge trade

4. PB#s 3 and 7 are only to be taken Live unless Rule#1

5. Only A or better setups at time of Live trade

Challenges for myself this upcoming Week:

On mic trades only with my small group if available

Take a planned break at 1100 or 1200 for other Bus.

@ 0905 do some exercise and then meditate to calm myself

Stay unbiased

Notes:

Rules are not to be broken, these will cost money every time

My Challenges are almost as important as my Rules, Pay attention to them

Goals and Rewards:

+20Rs or more at end of the month to consider trading with more size in the future two months +11.6R for the week

-

2

2

-

-

-

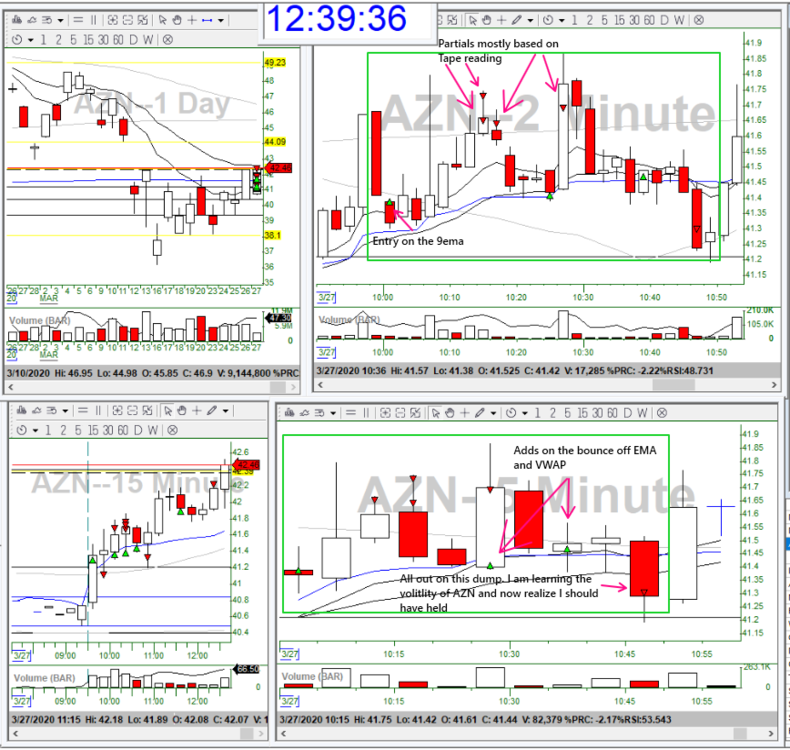

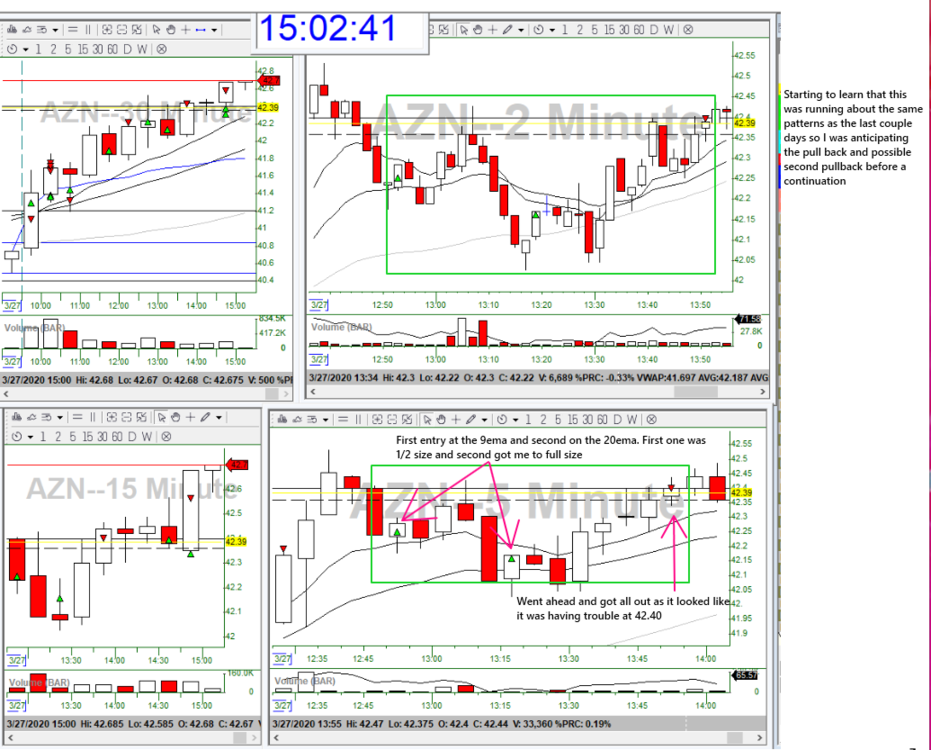

3-26-20

AIS 0800, 7 hours, 7/10

PAT: Trading outside of my PB#s 3, 7 or opportunity scalps

Arghh... Over-trading, taking scalps outside of my playbook costing me money

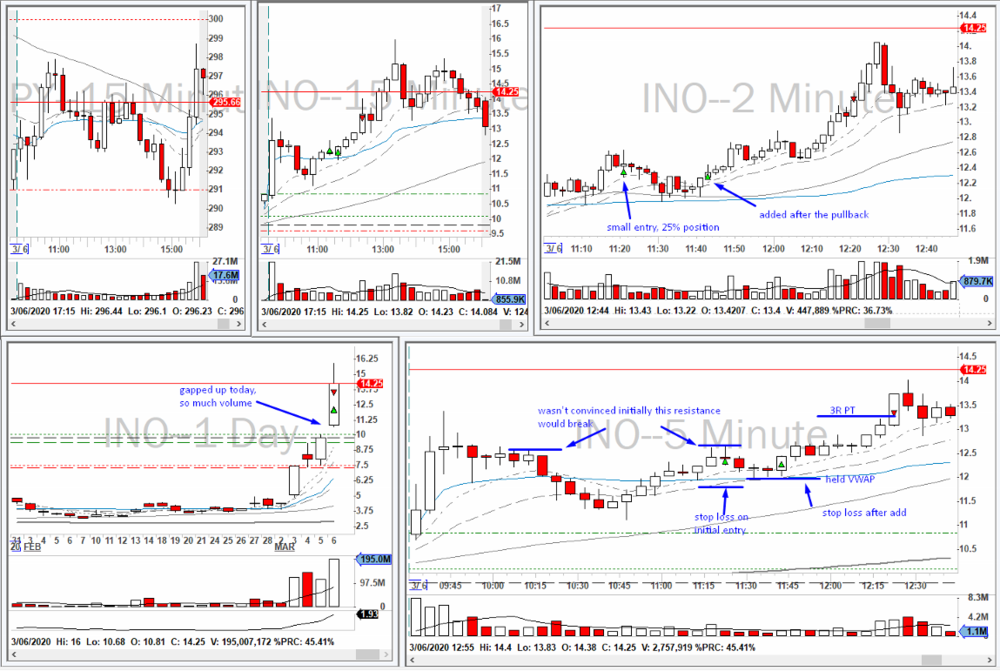

Charts do the explaining

Cons: over-trading, took plays outside of my playbook

Pros: Got a great entry on my PB#3 first trade

Rs: -1.8R

-

2

2

-

-

3-25-20

AIS 0805, 7.5 hours, 7/10

PAT: Only PB#s 1,3 or 7. No over-trading. A+ setups only. PB#3 Live only

BA

PB#1

Using PM L2 and Daily at 14.00 went long on the bounce. Partial I tried at top of candle but price fell fast. All out at loss of 14.00

Reversed on same PM, I forgot to reset my size for my stop so it reversed the position by half size. I wanted to short it at 13.93 but missed it and was talking to my trading buddys how I missed it till I looked at my open trades LOL guess it was meant to be. Then I made a mistake when I added to the short and corrected it. Took a partial at PML and 11.75 on the stall of Tape. Added at PC took off original position. Tried another add at PML and all out on the fail.

PB#7

Mistake was made when I entered in at 1030 for 12.80. As per my PB#7 I should wait for a pull back to the EMAs. This would have kept me in the trade for a long run and a bunch more profit.

After this trade I scalped successfully and not so. and on to the reversal shorts.

+4.8R

Cons: Over-traded a bit at the end with the scalps

Pros: Was able to recompose myself for a good short

PB Trade: Document PB#7

Rs: +4.8R

-

2

2

-

-

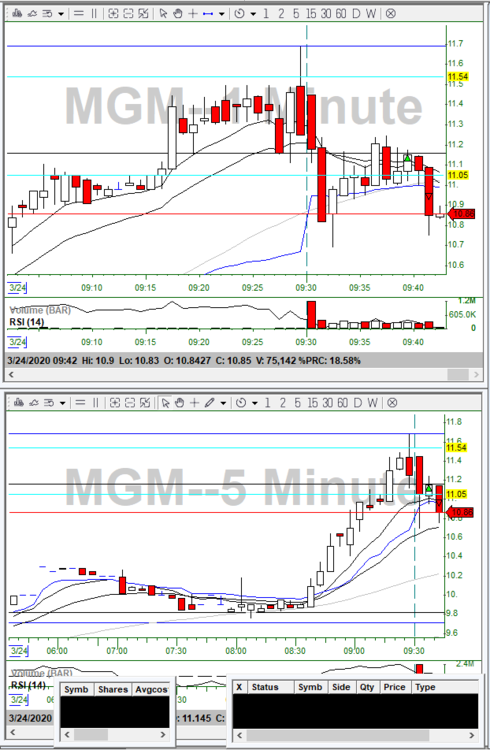

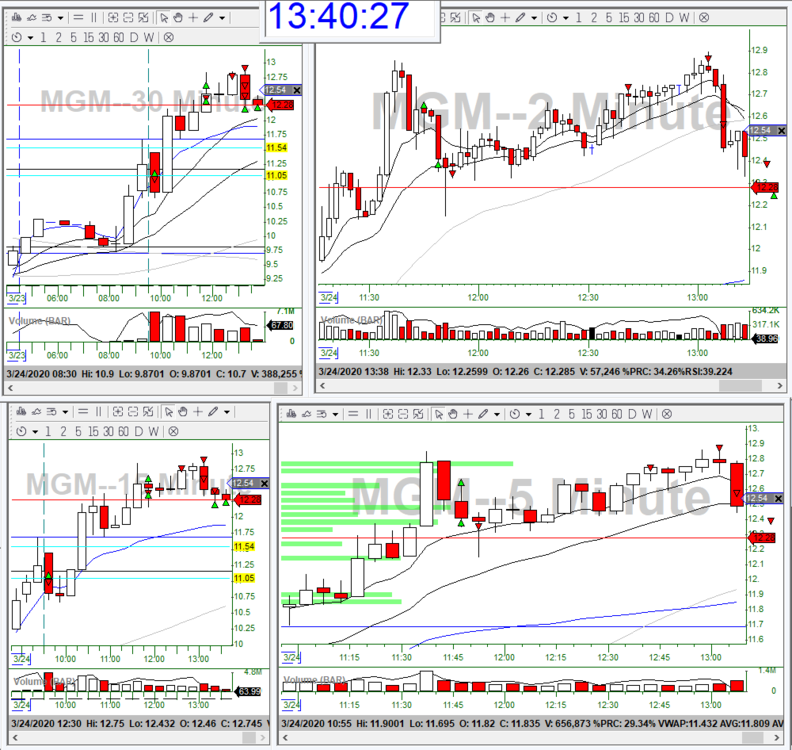

3-24-20

AIS 0805, 7 hours, 7/10

PAT: ONE Stock once I find it. PB#3 Live only.

MGM

PB#2

Bounce off VWAP and broke a 11.05 L2 level failed to below VWAP

-1R

GILD

Rev. ABCD Failed to C

-1R

PB#3

To early of a trend of the 9ema on the 5min failed at VWAP

-1.4R

PB#3

took it at the return to the EMAs on the 5min and failed below VWAP with an explosive move taking me below my Stop

-1.8R

MGM

PB#3

trending the 9ema took a nibble in sim and when it came down to .40 took it live (and accidentally took 1/3 share size) and got out of sim right after. was able to grab two small partials before the dump and all out.

+0.4R

PB#7

Marked Chart

+3.6R

Cons: Over-traded the morning Taking trades outside of my playbook.

Pros: Feeling more confidant in my PB#3 and PB#7 trades

PB Trade: MGM PB#7

Rs: -0.2R

-

2

2

-

-

I have similar problems with shorting in CMEG. A lot of stuff others have shorts for we do not. It will just make us that much better later.

Have a good night and trade safe tomorrow

-

1

1

-

1

1

-

-

3-23-20

AIS 0800, 7 hours, 7/10

PAT: PB#3 Live. Find one active ticker and focus on it for the day.

GILD is my first choice for my all day stock.

MGM this was my second choice but at the time GILD was not giving me any signals or entry

PB#1

15min ORB failed to my stop at VWAP

-1R

GILD

PB#3

Trending the 9ema on the 2min and failing to break the PM Low. There is also a reverse ABCD on the 5min. after consolidation for a bit it fell giving me partials and adds along the way. My adds were always 1/2 of the shares I had left and my partials were 25%

Room4Improvement: I should have added more on my adds as the action was going as planned. These should have increased to atleast my original share price or even more. (chapter 9 of the Playbook, Trader Wus syndrom.

+5R

GILD

PB#7 to PB#3

2nd new 15min hi, new 30min hi, 1 and 2min EMAs crossed and sloping to the 50ma, RSI on 15 was 19.1. Called this out way ahead of time but was back and forth to the desk so I caught this a bit late. Partials and adds should be self explanatory

+4R

Cons: Happy with the adds and partials as in where they were but not on the size (GILD 1st trade)

Pros: Took the trades, partials and adds when called out

PB Trade: GILD

Rs: +8R

-

2

2

-

-

3-916 to 3-20-20

What I did bad this week:

Technical Errors: Wrong hotkey twice in one trade. Forgot to put a hard stop in place and the price dropped fast costing money.

Trade management: Missed an add when I called for it. Missed a scalp when I knew I should have taken it.

Jumped the gun and chased, one of each.

Letting personal distractions get in the way of my trading costing money

What I did good this week:

Respected my in trade and daily stops. Did not over-trade.

Took most trades on all of the days that I was calling out

Only too PB#3 live

Reading the tape well on focused days

Adjusted in-trade trading plan for the current choppy market taking more partials and scalping more. Staying in control of my emotions for most of my trades

Changes to be made this upcoming week:

Work on my Trend Scalps as Scalps and not long term Trends

Rules to stick by this upcoming Week:

After I call it a day by either MAX Loss, Profit Target or what I am comfortable with, only use the rest of the day in SIM unless it is an A+ setup then only give back what is in my plan

In-Trade and Daily Stops

Do Not chase or revenge trade

Live Only one loosing trade before 1100

Challenges for myself this upcoming Week:

Only A or better setups at time of trade

On mic trades only with my small group if available

Take a planned break at 1100 or 1200 for other Bus.

@ 0905 do some exercise and then meditate to calm myself

Stay unbiased

Notes:

Rules are not to be broken, these will cost money every time

My Challenges are almost as important as my Rules, Pay attention to them

Goals and Rewards:

+20Rs or more at end of the month to consider trading with more size in the future two months +1R for the week

-

2

2

-

-

3-20-20

AIS 0800, 6.5 hours, 6.5/10

PAT: Chasing. Placing hard stops. Only PB#3 in live.

TEVA

first two trades were PB#1 in SIM

-1.3R

two min orb failed and a reentry for a 5min orb. took partials on the way down and stopped myself out with a manual trailing stop at previous partial

+3.2R

PB#3 Live

third trade live. Trending the 9ema on the 2min with initial risk above VWAP. Once it chopped and the MAs dropped to the 5min I reset mt stop to a new 15min high. Stopped out.

-0.5R

PB#3 Live

Trending the 9ema on the 5min. partial and an accidental add then took a partial right away. AND I did the same thing again, arghhhhh. (I have been distracted with other things and I need to be very carefull). took another partial on price action change.) All out a new 15min high. I flipped the position in SIM and let it come back to BE. I told myself to take the partial at .49 but I hesitated and lost the profit

+2.6R

Cons: Slight mismanagement on an add and the scalp on the reversal

Pros: pretty much stuck with one stock for the day and found a few trades in it

Rs: +4R

-

2

2

-

-

3-19-20

AIS 0755, 7 hours, 7/10

PAT: Over-trading (no speculation). PB#3 only live trades. only 1 loosing trade before 1100

MRNA

PB#3 two trades, first live looser and second sim looser

First trade based on the 9ema on the 1min. Bad entry as I was chasing and stopped out at the 20ema on the 1min. -1.2R

Second trade based on the 9ema on the 2min. added on during the chop for a move to 35.00. It completely puked and shook me out. -3.2R

-4.4R

SOXL

PB#3 trend scalp on spy action. this is also sim as I do not usually trade this ETF

+1.2R

SBUX

PB#3 Sim as I did not like the speed of the puke

During the puke I though it was a shake out and entered late with my stop down at 60.75 which was too far away for my liking so I moved it to 61.20 and got stopped out which turned out to be a bad idea as the end of market I would have come very close to BE

-0.5R

Cons: Chased first trade and did not have a hard stop on the second

Pros: Took the setups and add on MRNA according to my in-trade rules

Rs: -3.7R

-

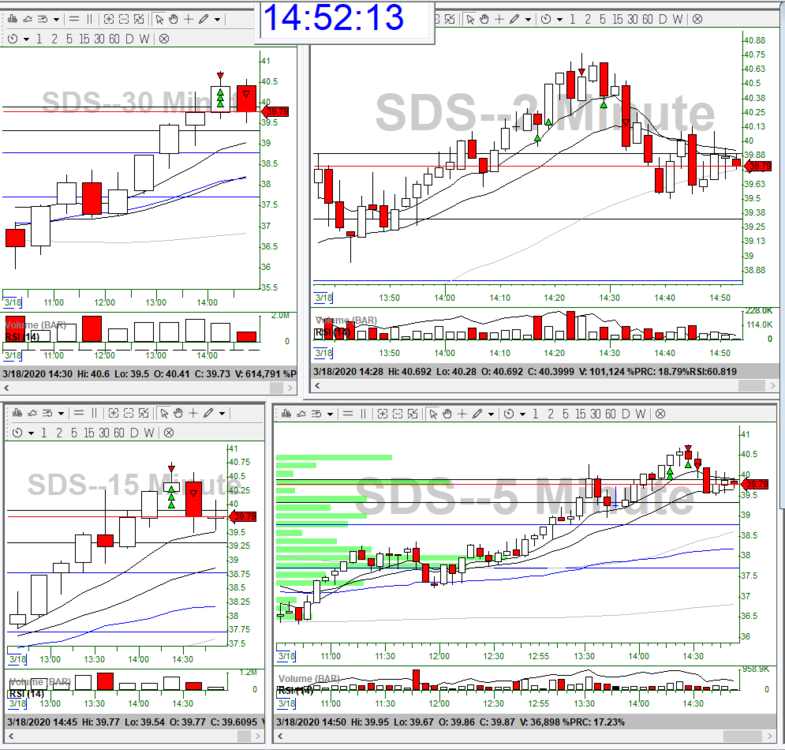

3-18-20

AIS 1325, 6 hours, 7/10

Notes: Last night was the last night for Tabby and Is work until COVID-19 is no longer a national threat. We are lucky enough that we are both management and will continue to get paid a good portion of our wages (never the less this will be a big hit for us). Tabby being the GM for her company has had to call many people to let them know they were all being laid off with a two week severance. So to say the least we are pretty much exhausted as this is not an easy thing to do.

PAT: Over-trading. PB#3 Live only.

CCL

PB#3 PB#7

This setup presented itself as soon as I got on and therefor I was unable to give it the attention before I took the trade so I went in with 1/2 position. Took profit at 1R and 3R then added the unrealized profit for a BE stop.

+1.4R

SDS

PB#3

My way of shorting the SPY. Took it at the 9ema on the 2min and with confirmation I added on. Took 50% off and tried to add on againg but it took me out at BE.

+0.6R

Cons: Jumped the gun on the first trade as I did not have enough info, but I did take a very small size

Pros: took the trades when they presented themselves

Rs: +1.8R

-

3

3

-

-

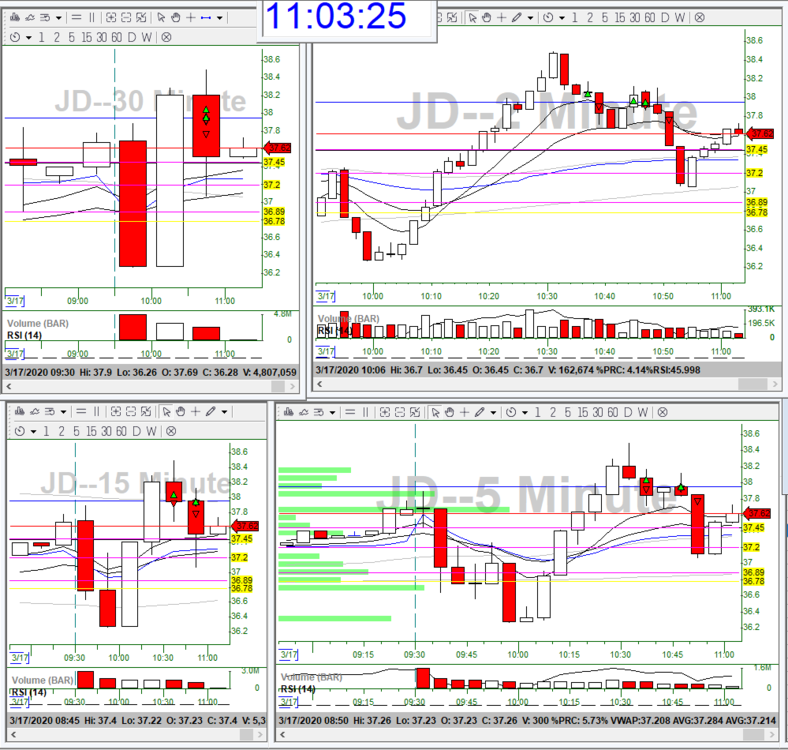

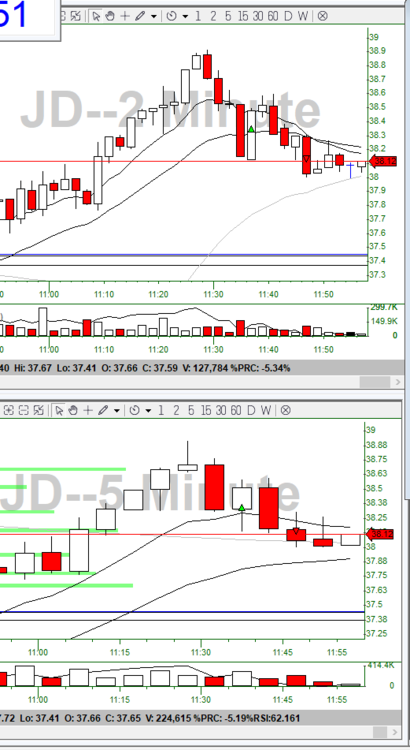

3-17-20

AIS 0805, 6 hours, 6/10

PAT: A little fatigued right now, will see at the open. PB#3 only. Over-trading

MRNA

PB#3

Trending the 9ema on the 1min enter on the pullback to the 9ema. Didnt quite make my first partial and came back to stop me out at my new stop (original stop was below the 20ema and let it follow).

This was my one loosing trade before 1100 so the rest is SIM

-0.4R

JD

PB#3

All three are all based on the 9ema trend on the 2min and no new 15 min low. These were all intended as scalps but never got there. All positions even though SIM were kept small

-2R

Cons:

Pros: took trades as they are called out

Rs: -2.4R

-

3-16-20

AIS 0800, 3.5 hours, 6/10

PAT: Pay more attention without micro managing. PB#3 Live only.

JD

PB#3

Trending the 9 on the 2, risking the 20 on the 2. Took 50% at 2R, added 1/2 then all out.

2nd trade in again on the 9ema on 2min, took the scalp as I had to get fabric together and answer work texts.

3rd trade. This time waited for the 9ema on the 5min. Took it when it pulled back through the 9 and the return. Stopped out on the new 15min low.

+1.8R

Cons: lots of distractions costing me money as I did not give the market my full attention

Pros: Took the trades when I called them out

PB Trade: JD

Rs: +1.8R

-

2

2

-

-

3-9 to 3-13-20

What I did bad this week:

Technical Errors: Miscalculated R/R on one trade

Trade management: Did not pay enough attention when the trade was close to my adds and partials. Missed a scalp when I knew I should have taken it. Did not follow my plan on one trade.

Jumped the gun and chased, one of each.

Was still tired at the open on Tuesday

Too many tickers on my watch list

What I did good this week:

Respected my in trade and daily stops. Did not over-trade.

Doing better on my call outs and taking more of my trades

Only too PB#3 live

Reading the tape well on focused days

Adjusted in-trade trading plan for the current choppy market taking more partials and scalping more. Staying in control of my emotions for most of my trades

Changes to be made this upcoming week:

Work on my Trend Scalps as Scalps and not long term Trends

Rules to stick by this upcoming Week:

After I call it a day by either MAX Loss, Profit Target or what I am comfortable with, only use the rest of the day for Chat, Journal, Playbook ect.

In-Trade and Daily Stops

Do Not chase or revenge trade

Live Only one loosing trade before 1100

Challenges for myself this upcoming Week:

Only A or better setups at time of trade

On mic trades only with my small group if available

Take a planned break at 1100 or 1200 for other Bus.

@ 0905 do some exercise and then meditate to calm myself

Stay unbiased

Notes:

Rules are not to be broken, these will cost money every time

My Challenges are almost as important as my Rules, Pay attention to them

If I feel overtired I will try going back to bed and coming back to Trend Trades later....

Goals and Rewards:

+20Rs or more at end of the month to consider trading with more size in the future two months +12.3R for the week

-

1

1

-

-

On 3/12/2020 at 4:29 PM, Mike B said:Thank goodness for risk management this week. I have been on a negative streak and it seems all the trades I don't take work and all the trades I take don't work. The all reason to take every setup if it is within your edge. I did not follow that today with $MU and missed two opportunities that would have netted me nice gains. Instead I took a trade on $JD and it netted me -.5R. Oh well what are you going to do but learn.

I feel like I do the same sometimes. I call out trades in my small group and someone makes money in the group (not me because I didn't even take the trade I called out

). Like you said, live and learn.

). Like you said, live and learn.

-

1

1

-

-

9 hours ago, Mark D. said:Thanks Glenn! Yes, exactly. The Playbook style makes a lot of sense to me. Helps me have more confidence in my trades

Did you take their course?

I laugh because when people ask me if I have read the Playbook my response is, I think I read it three times but have yet to make it half way through it. There is so much info in it.

-

-

3-13-20

AIS 0755, 6 hours, 6/10

PAT: PB#3 A or A+ Live Only. Over-trading. Stick to the screen.

OXY

PB#1

10min ORB, a reverse ABCD back to the 9 on the 1min. Failed

-1R

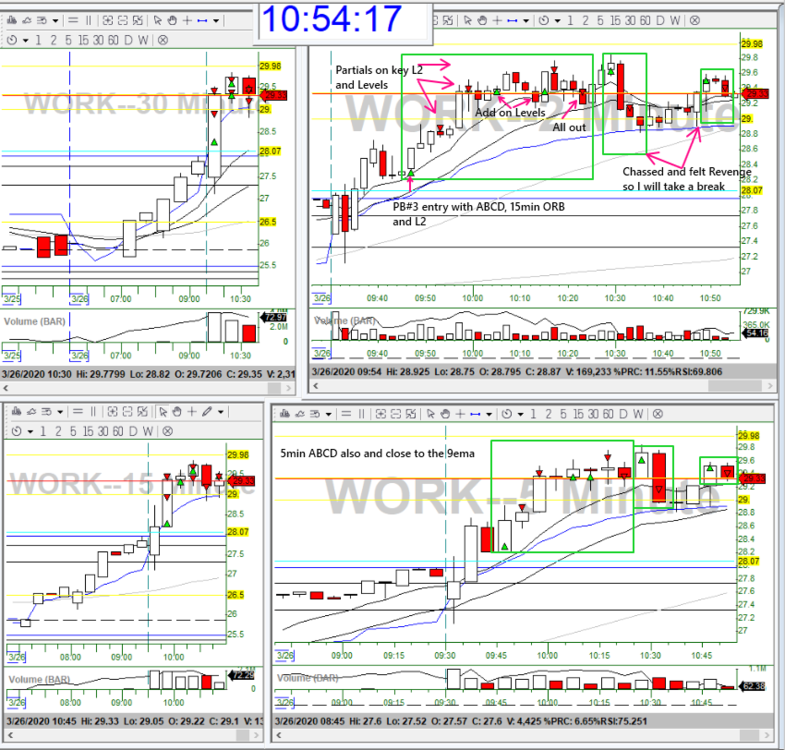

WORK

PB#2

First entry short on the retrace to VWAP, As I got into this trade one of my trading partners went long. I should have scalped it but instead let it come back and stopped myself out at BE from fear of it going against me (with my trading partner long into the position). Lesson learned to stick with my plan.

PB#3

Second trade. After this went the way I thought it would I was able to get another entry at hr return to the 9ema on the 2min risking the middle of the 9 and 20 on the 5min. Scalped for a not so quick +1R

Third trade was the same except I got stopped out for -1R

PB#3

Fourth trade. Back from lunch and looking at new setups. Found this again except this time we are trending up. Once it pulled back past the 9 on the 5min and came back through I went long for the trend. After the first and second partial I was looking to add back in but missed my entry twice talking too much and not paying enough attention. Took two more partials and at this point I left myself with too little share to partial anymore so I added in when I got the chance and closed the day at the top with 3 seconds left.

+3R

Cons: Did not pay enough attention to my last trade but also trying not to micromanage it. Let chat get the better of me with emotional trading. Had too many stocks on my watch list.

Pros: Took most of the trades when I called them out (trusting myself a little more)

PB Trade: WORK fourth trade and first trade not letting it stop me at BE

Rs: +3R

-

2

2

-

-

3-12-20

AIS 1115, 7 hours, 7/10

JD

PB#3

Trending the 9 on the 5, entry based on the 2min. Add on again on the bounce off the 9 on the 2min. Took a partial and once I seen the momentum changing I took the rest off.

I should have scalped the first entry and made the second entry another scalp as this is where it seems to be more profitable in the current market

+3.5R

CY

PB#3

Trending the 9 and not trading with SPY. First entry was based on the 2min pullback to the 9 with a bounce and add on was the bounce off the 9 on the 5min. I was also watching a held bid along with T&S for the add. Took profits at key points on the L2 and daily levels and all out at BE.

My R/R on this setup was bad and miscalculated

+1R

Cons: Miscalc. R/R ... Should have scalped the JD trade

Pros: Took most of what I called out but missed one.

PB Trade: JD

Rs: +4.5R

-

3

3

-

-

3-11-20

AIS 1150, 7 hours, 7/10

CCL

PB#3, B setup

Trending the 9 on the 5min with a retrace to the 20. I got to the desk at 1150 and found this at 1152. Took it quickly in SIM because I was not able to evaluate it fully. This is not a normal setup that I would take for my PB#3 and was taken in SIM

-0.4R

JD

PB#3 (1rst trade)

Trending the 9 on the 5min with a pullback to the 9 for entry. Took a 50% partial at whole dollar and a marked level from the daily which also is showing resistance on the intraday and all out at BE

+1R

PB#2 (2nd trade) a VWAP play that did not work right off the bat.

-0.6R

Cons: None

Pros: stayed in control of this choppy market

Rs: +0.2

-

3

3

-

-

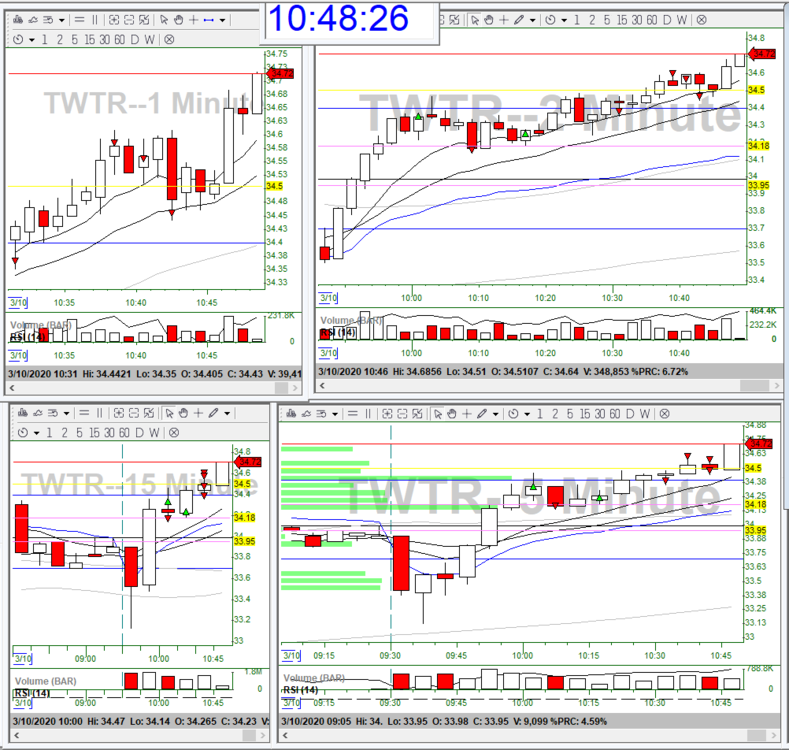

3-10-20

AIS 0800, 4 hours, 5.5/10

PAT: Over-trading... PB#3 in Live only ... stick with stocks in play....

TWTR PB#3 two trades....first one was over extended and I knew it but reduced share size. goal was to scalp it but I did not because of the small size I had which was a mistake on trade management. second entry was much better and I did take the same amount of share size as to not skew the Rs for this trade. with partials and an all out on new bad price action and tape. this did end up coming back to 34.40 as of this post and I am happy with the all out.

-0.2R

.Cons: chased first trade... was very tired and maybe should have come back later

Pros: getting out now before I do something stupid as I am very tired

Rs: -0.2R

-

2

2

-

-

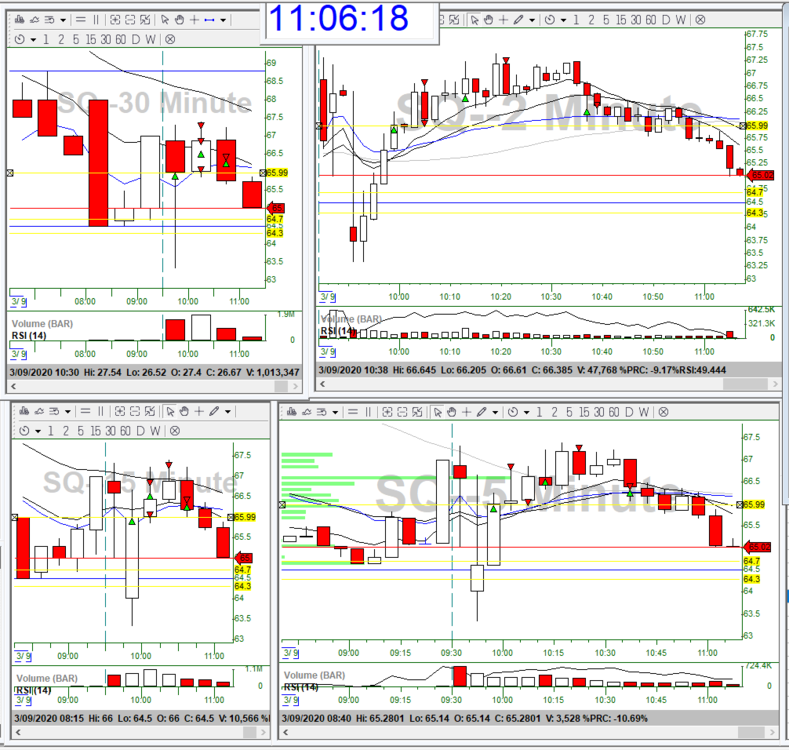

3-9-20

AIS 0800, 4 hours, 6/10

PAT: Live trades in PB#3 only.... Over-trading ... One Live looser only before 1100 ... more scalps with volatile market...

AMD

PB#1 5min ORB forming an ABCD on the 2min above the 9ema, after it started to go up it immediately turned against me so I stopped myself out early. my stop was below VWAP so I did save money but should have stuck with it....

-1.2R

SQ

PB#3 Took a series of 3 trend scalps using 65.99 level and HOD

+2R

CCL

PB#3 Trend scalp Was wanting it a bit higher but I set my order a little too low to make sure I got filled and took a scalp for 1R

+1R

SQ

PB#3 after the extended pullback and breaking VWAP, 65.99 level and the EMAs on the 5min for a trend up on the 2min. a 1min abcd with a stop at 65.98. First partial was 50% the next two were 25% each and all out on the fourth

+3R

Cons: Took my eyes off of AMD. Jumped the gun on CCL trade

Pros: Took positions when they arise

PB trade SQ second chart

Rs: +4.8R

-

4

4

-

-

3-2 to 3-6-20

What I did bad this week:

Technical Errors: Forgot to remove a stop order and ended up in a short that I did not want

Trade management could have been a little better but overall it is getting better

Over-trading on 1 day

Took my eyes off of charts for journal to miss a great opp

Took Live Trades outside of PB#3 on 1 day

What I did good this week:

Respected my in trade and daily stops

Got out after either stop for the day or a goal in mind and did not trade the rest of the day as planned on all days and did not Over-trade

Stuck to my plan on 2 days

Reading the tape well on focused days

Adjusted in-trade trading plan for the current choppy market taking more partials and scalping more

Changes to be made this upcoming week:

Work on my Trend Scalps as Scalps and not long term Trends

Rules to stick by this upcoming Week:

After I call it a day by either MAX Loss, Profit Target or what I am comfortable with, only use the rest of the day for Chat, Journal, Playbook ect.

In-Trade and Daily Stops

Do Not chase or revenge trade

Live Only one loosing trade before 1100

Challenges for myself this upcoming Week:

Only A or better setups at time of trade

On mic trades only with my small group

Take a planned break at 1100 to 1200 for other Bus.

@ 0905 do some exercise and then meditate to calm myself

Stay unbiased

Notes:

Rules are not to be broken, these will cost money every time

My Challenges are almost as important as my Rules, Pay attention to them

If I feel overtired I will try going back to bed and coming back to Trend Trades later....

Goals and Rewards:

+20Rs or more at end of the month to consider trading with more size in the future two months +8R for the week

-

1

1

-

-

3-6-20

AIS 0805, 6 hours, 6/10

PAT: PB#3 Live Trades .... Over-trading ....

JD

PB#1, 5min ORB, ABCD on 2min, partial then bigger add on than I should have and stopped

+0.2R

AMD

PB#3, testing the PML for the third time for a new trend entry, very tight stop. If momentum does not carry it quickly to RED/Green then its time to stop. I was more aggressive on the partials due to the current choppy market conditions. All out at 1108 but realized shortly after that I forgot to take and order out and I was short and covered as soon as I realized it.

+2.5R

JD

PB#3, trend scalps. These are three individual trades and all were mainly based on L2 and T&S with confirmation of the chart and levels off the chart.

+4.5R

Cons: did not remove an order on AMD and got lucky that it did not make me pay the price. Took my eyes off for journal and missed moves on JD

Pros: Found my setups and worked them to the current market, Scalping and taking more partials

PB Trade: AMD

Rs: +6.2R

-

2

2

-

Budde (Booty) Trading Journal

in Day Trading Journals

Posted

3-30-20

AIS 0755, 7.5 hours, 7/10

PAT: Over-trading outside of PB#s 3 or 7

GILD

PB#3

+0.2R

MU

-2.02R

Cons: I am still chasing and loosing focus due to other work related issues with this Virus

Pros: Kept my losses small even on bad trades

Rs: -2R