-

Content Count

27 -

Joined

-

Last visited

Posts posted by misterchai

-

-

Hi all,

Late notice but I'll pop in (poker_dealer in chatroom if I have spoken to anyone, although infrequent contributor these days)

See you all there

-

Would love an invite if open guys. Always looking to join more discords, especially BBT affiliated ones

-

Hi Mark,

I use CFDs to trade indicies. I live in London.

Not quite sure what you mean by CFDs are heavily leveraged AGAINST the trader in favour of the broker. Yes, I believe Aussie CFD brokers/market makers will give you 20x leverage, but essentially all it means is you need less margin to trade the same position size. If you are sensible and manage risk the high leverage won't be a problem. In fact, in the UK, since 2018 after the ESMA rules to restrict leverage to protect retail traders (think gamblers) index CFDs have been restricted to 5x leverage. I actually have both an Aussie and UK account with the same broker. I just need to have less money in my account in order to trade the risk that I want (when using the aussie account) Since I only really swing trade indicies and commodities occasionally, I don't want a chunk of money sitting in my UK account doing nothing, I would rather have 4 times less in my Aussie account in order to trade the same size.

The thing to remember with CFDs is the spread, especially on equities intra-day which can make them difficult to trade, at the open at least. Take AMD for example, at the open the spread on the underlying is 1c, most CFD brokers wrap their own 10-15c spread around that, or charge prohibitively expensive execution costs. I believe interactive brokers offers CFDs (at least in the UK), and they are probably your best bet.

If you are looking to just trade ASX, when it comes to indicies and some commodities, most of these brokers offer fairly decent spreads as the retail market place has become quite competitive.

Hope this helps

-

Version 2.1 is the latest release correct? Kyle, the alpha you have created in this community (and my own trading) is astounding. Thank you for everything Sir

I am indebted to you.

I am indebted to you.

-

Sorry for the tardy reply!

-

Hey everybody, sorry Pit-man I know I said I was in, but I will actually be away in Vegas over these dates now.

-

Thanks for this idea, I actually took everything off before Powell speech yesterday, took it long for opening drive today. Glad you held and made bank!

-

1

1

-

-

This is exactly what I should have done today

-

2

2

-

-

-

I have some great books on technical analysis tailored to position trading off daily and weekly charts, like William O'Neil's “How to make money in stocks” and several books by Mark Minervini, but can anyone recommend anything which is expressly aimed at intra-day equity trading? Something similar to Bellafiore’s Playbook or One good trade?

Thanks

-

YES! Thanks Robert

-

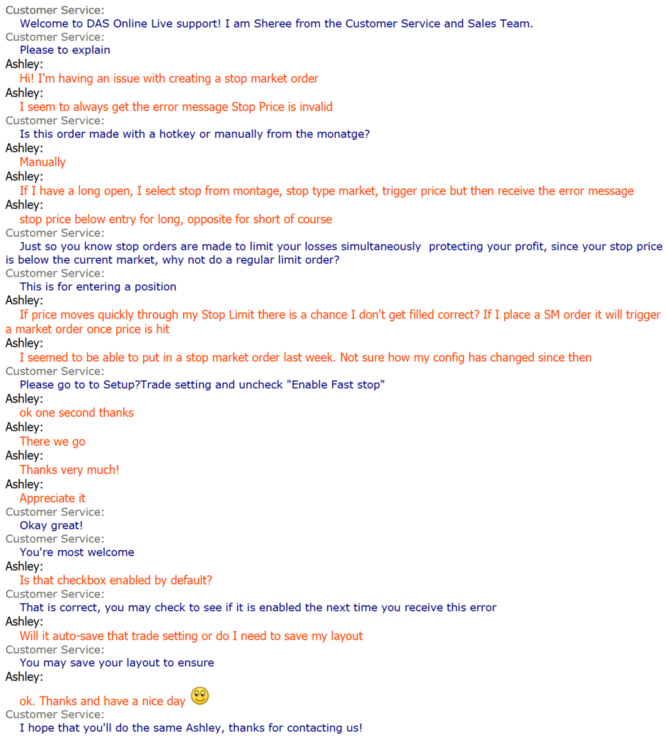

I started having trouble creating stop market orders and wasn't sure what was wrong. DAS live chat support helped me and fixed the problem. If you are getting the "stop price is invalid" error, try:

setup > trading setting > uncheck the box "enable fast stop limit order"

Chat log is below:

I thought I'd post if anyone else starts having this problem and searches the forum

I'm not sure if this box gets checked automatically if you enable double click to trade. This might of been what happened.

-

And then link that to your platform, got it thanks Kasper

-

1

1

-

-

I assume that if you take an overnight position you are charged interest on the margin, the amount being broker dependent. Is there a DAS setting to switch to using cash only on longs, and not margin as buying power?

Thanks

-

Thanks again Kyle!

-

Yup that'll do it. Thanks for the a'ha moment!

-

I just watched a trade recap (not from BBT) where the trader was using TWO VWAPs. The standard VWAP, but also a second which excluded premarket data. He was using it as just another significant level/partial point.

Does anyone have any experience of doing this?

Thoughts?

-

I played SLDB today long, which was on SSR. When trying to exit and sell, I got the error message of "short marketable limit order disabled due to SSR". This was using the Sell All @bid-5c script. But even when I selected a market order from the drop down menu and clicked the red short button on the montage I recevied the same message. I had to Shift+ESC to close the position. Is there a way to simpy sell @ the ask when the stock is on SSR? What order did I end up making when I had to SHIFT+ESC to close the position?

Thanks everyone

-

-

I can't seem to be able to find the hotkey to quickly add new rows in the market viewer windows. How do you do that, insteaed of 'right click, new row'?

Thanks!

.thumb.jpg.546089a86f0ecd03e688981c010e6d71.jpg)

2023 Meet-Up in London, UK Jan 5th

in Members Introductions & Meetups

Posted

In!

Looking forward to meeting you and others Peter. Hopefully will see some faces from the previous meetups