JenniferL

-

Content Count

67 -

Joined

-

Last visited

-

Days Won

2

Posts posted by JenniferL

-

-

Starting a separate journal for day trading

-

14 hours ago, WilliamH said:@JenniferL Thanks so much for joining our community and for introducing yourself. I see you are in Switzerland. Did you by chance go to the recent meetup the other day

and get to meet Andrew?

I am out of town this week! So bummed to miss the meetup tonight, but my husband is going for me!

-

2 hours ago, Abiel said:Hi Tom, we have someone from Basel interested in attend this meetup, asking for specific place / time. Could you please provide input?

Frascati, Bellerivestrasse 2, Zürich, 8008, Switzerland

Not sure about the time -- it says 12-4PM on the calendar, but the announcement in chat today said 7PM -- think it might be a time zone calendar issue.

-

I am unfortunately out of town, but can you provide some specifics? I'd like to see if my husband can go, and I can live vicariously through him!

-

Aug 1-3 Busy with family and visitors so have not been able to give appropriate attention to trading. Looks like a smart choice.

Brian's swing trading update said: "Got to be pretty active as a swing trader in this market with the wild moves. If you can not stay on top of things, best to wait it out or keep positions on the small side. "

I was watching market some of the time -- lesson confirmed -- you never know what tweet will mess up my plan. I have to be on it!

Still playing with Stock Charts scans to screen for setups.

-

6 hours ago, nassarsyed said:I would not move stops and let things work. You really have to think I’m germs of risk reward and over several samples.

I look at max loss in a single trade as 1%. Will move to 2.5% when more confident gradually.

This is what I call 1R so currently that’s 1% of my working capital.

You have to give it long term I was up 3.38 R, than down to 1.28r than now closing July with 4.61R which is 4.61%

made mistakes and could have closed 6% or higher and if I use 2.5% as max loss, that would be a return of 15% for the month at which I could double my account compounded in 5 months....

there is juice in this stay with it

for relatives, that’s the beauty of swing trading do your analysis at night, trigger your trades in 1st or last hour or on buy sell stop, put in stop loss and walk away..... next day take profit, loss or adjust stops....

Thank you so much for sharing your experience. I cannot tell you how much I appreciate your feedback. I am feeling quite dejected at the moment. I did not risk more than 1% on any trade, but now I can see how quickly one could be out of this altogether quite quickly. So happy that BBT emphasizes the importance of sim. Every loss teaches me so much.

One of the most important things I need to do is learn how to use DAS. The platform I am in right now does not have a good sim -no real time data, no retention of my trade data.

I really am having so much fun though -- there is so much to learn and test and adjust, and test again.

I do not have time to do any rigorous screening right now, so I will wait to take a trade until I can give it the attention it deserves. I imagined myself picking up some GE at $10.06 today (I watch it everyday) , and then just stalked it for 3 hours. If I had more experience, maybe I would have jumped on it. I am treating my sim account like real money. I need to have the emotions baked in when I go live.

Again, Nas, I really appreciate your taking the time to give me your input and your encouragement!

-

2

2

-

-

July 31 PM

NVDA Got stopped out at 171.25 after Fed announcement -- Lesson learned - macro market moves are a real thing -- pay attention to the bigger picture -- don't enter a swing trade when I know that there is change sure to come in the near term.

SBUX -- stopped out 96.25 at open - ORB -- I need to pay attention to premarket so that I can see what is happening

BIG learning -- looking at the Direxion Bear ETFs -- all are rising while the market is falling. I did read about this phenomenon in Brian's book -- the option to trade an inverse fund rather than shorting. I think this could be a very interesting way to go -- concerned about fees on ETFs but will focus on learning how to trade first, and then how to make it profitable later.

I am really not sure that swing trading is any less forgiving that day trading -- intraday shenanigans still impact my trades, I am just not paying attention. Yes, I can say I think this is the way this will go, but something can always happen, and if I am not watching, I will get screwed.

-

Thanks!

-

1

1

-

-

19 hours ago, nassarsyed said:My 2 Go to filters are price moving over 20 MA and other one is the a hook, like the one I am posting on NFG next.

Thank you! I did not see a follow up NFG post, but did see TSLA. Is that the one you meant?

-

July 31, 2019 AM

Out-of-town visitors for the next 10 days so it will be hard to trade. I have not been screening for new opportunities. Still in 2 trades - NVDA and SBUX.

NVDA - was green EOD yesterday, went lower at the open but moved up. Made me pretty nervous. I felt like I wanted to move my stop, but I have to just let it do its job which is to protect my account! If I had been actively watching all day, I could have taken some profit and moved my stop up to my entry price. Need to learn how to partial out.

SBUX -- realized that I made a mistake in my calculation and my trade only has a 1:1 RR. Moved my stop up to 96.25 for 2:1. This is just a little above low of day.

-

1

1

-

-

-

Symbol: PYPL

Entry Date: July 29

Long or Short: Long

Entry Price: $?Stop: $?

I pre-entered the buy order,with stop loss. Bought and got stopped out in the first seconds of the day. I did not record the data fast enough so cannot enter from Saxo sim.

Lesson learned -- I have to make the trade myself, not expect it to work on autopilot.

-

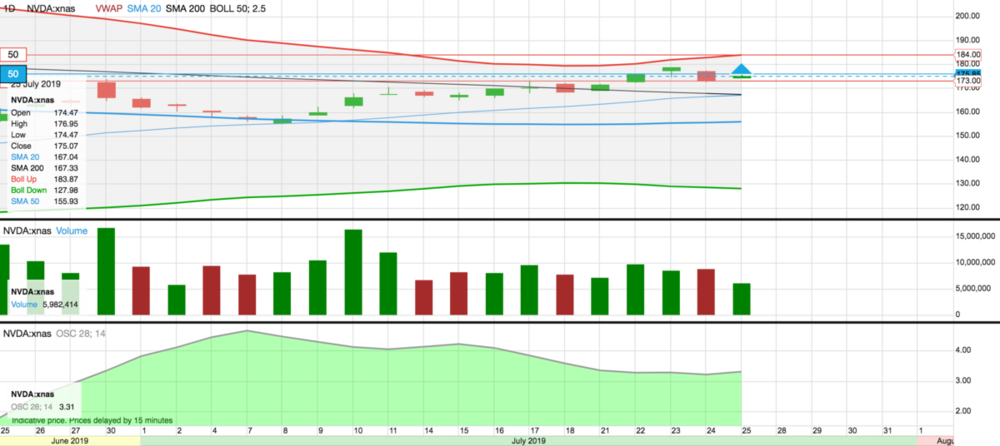

Symbol: NVDA

Entry Date: July 29

Long or Short: Long

Entry Price: $174.19Stop: $171.28

Target price : $184 (Upper Bollinger Band 50;2.5)I reentered this trade when the 20 was about to cross the 50. I got a much better entry than I had on Friday, 174.19 vs. 175.85 but it could have been better. It did not occur to me until later in the day that I could actually do that. From 10:15 candle on 15-min chart, there were only HHHL. Decent ABCD on 5 minute from 10:10-10:45 -- If I had been watching the stock I could have gotten in at 172.35.

Recalculated my RR using low of the day as my stop out, and upper BB 50;2.5 from the day before as profit.

I felt good about getting back in (TTT) but really had to do some creative accounting to come up with a decent RR.

I learned that the BB change a LOT depending on the time frame and how I set them. Seems like I could justify almost anything using this as a way to set levels.

I also watched the MACD which I find an interesting indicator -- I will have to get used to understanding what it is telling me.

Could be counterproductive to look too closely at what is happening intraday when taking a swing trade, but in this case, I wasn`t out on the first strike.

-

3 hours ago, AAgnostic said:Hi Jennifer! I was going to take that trade on DUST too, but I got chicken out at the last minutes lol

I am in sim, so decided to also test the question "what happens when I copy Brian´s trade?"

-

I live in Switzerland, and we actually have this tax. .15% per trade.

https://www.moneyland.ch/en/swiss-stamp-duties-definition

I am charged this by my broker on every trade, so I pay when I buy and when I sell. So if I take a $10K trade with hope of 1% return of $100, I am charged $15 when I buy and $15.15 when I sell. On top of that I pay $15 per trade in commission. ( I have to get it down but the lower rate of $6/trade only kicks in if I make 100+ trades per month.) Now I am at $60.15 and then add on the exchange fee at the end. If, God forbid, I should partial, there goes my profit.

It's a lot! I have reason to believe that my earnings are considered cap gain, not income because I am not a "professional" trader. Cap gains are not taxed here. If I do have to pay income tax, that will be another 30%.

It is pretty frustrating, but part of my induction into trading is to meet with a tax accountant to figure out how to get my fees down. I have read that if I switch to IB I will not have to pay the stamp duty since it is based in the UK and the requirement to levy the tax is only applicable to Swiss brokers, not Swiss residents.

I appreciate all of the mentors who remind me that I should focus on what I can control, i.e. how I trade, and less on what I cannot control!

Jennifer

-

Hi Nas -- Thanks so much for sharing your trades -- I am starting out with swing trading, and just did my first journal entries.

Can you share what parameters/tools you use for your stock screen. I am playing with Stock Charts and Finviz. Personally I like stock charts because there is so much educational material, Finviz is much simpler.

Thanks!

-

1

1

-

-

Hi Vikram! I watched your interview last night -- thanks so much for sharing your experience! Looks like we are neighbors -- I live just outside of Zürich!

Tchüss!

-

1

1

-

-

Hi AA!

I am just starting out myself. I started my first journal this weekend. At the moment, I am focusing on swing trading so I have put my journal in that section of the forum. When I work on day trading, I will make a new journal there.

I would be happy to share experiences with you! I can also tell you what I see when I look at your trades, but please take them for what they are -- I am definitely a newbie!

See you soon.

-

Symbol: NVDA

Entry Date: July 25

Long or Short: Long

Entry Price: $175.85Stop: $173, Previous Day Low

Target price : $184 (Upper Bollinger Band 50;2.5)UPDATE: Stopped out at 173 at open on July 29.

I am trying out free version of Tradervue to see if this is a good way for me to journal, but I cannot export my journal, so I am just copy/pasting!

I considered this trade when I saw pullback on the daily chart July 24. I saw an ABCD pattern forming. Also, appears that SMA 20 is crossing SMA 200.

Bought at 15:16 50 shares at 175.85.

Entry could have been better. I did not see a new low on the 5 minute chart at 15:10 candle and got panicky. It went down all the way until close at 175.07.

Did not initially do a good risk reward analysis. Stop out at meeting of SMA 20 and 200 - $168.00 For 2R the stock would have to get to 191.55 which was a level in April, but not the first good level.

On Sunday July 28, read about Bollinger Bands. Used BB 50;2.5 Set new stop loss between previous day low and previous day close- 173.00. Used upper BB to set take profit at $184.

I like the idea of trading in the upper range of the BB. Need to learn more about how to set them.

NVDA Earnings report on Aug 15 after close, so I need to get out before then.

Can't wait to see what happens tomorrow!

-

This is my first journal entry!

Symbol: DUST

Entry Date: July 24

Long or Short: Long

Entry Price: $8.18

Sold first partial: $ ?

Target price : $9 first target

Moved Stop: $8.3All out at approx 8.50 when Brian called it -- I need to record the numbers when I do it because Saxo erases the closed positions every night in sim.

I am just beginning my trading education. I am interested in learning both swing trading and day trading, but starting with swing trading for a couple of reasons. Mostly, I will not have the time to dedicate until after the summer vacation is over and everyone is back in school.

Currently, I am using a rather useless sim account from my broker here in Switzerland. I am in the process of setting up DAS and learning all the ins and outs.

For now, I can say that my first sim swing trade was/is a copy of Brian's $DUST trade. I got in at $8.18. I did take some profit, and moved my stop up to $8.30, but my useless sim account does not show me what I sold at. I still have some shares with a target of $9.00.

I am not proud of this trade since all I did was copycat. From what I understand, the thinking is that $NUGT had a series of days with no new high, and $DUST a corresponding series of days with no new low. This was coupled with strengthening USD. I am intrigued by the idea of playing these two ETFs back and forth. Will stay tuned for more information.

Looking forward to getting to know the other swing traders in the group!

-

Thanks for this, Robert -- great syllabus for my trading education.

-

Hi BBT!

I am an American SAHM from Houston, TX with a Danish husband (of 26 years) and 2 teenage kids. My family has lived in Switzerland for 16 years, and now that my kids are grown, I have some time on my hands. My location is perfect for trading the US markets, and I am looking forward to a methodical study and practice regimen to prepare for live trading.

I found the community after my sister recommended Andrew's book. I listened to one chapter where I first heard the term "swing trading." I promptly bought Brian's book, and have read through 2 or 3 times now! After doing a 2-week trial a couple of months ago, I was really intrigued. Now I have joined with Lifetime Membership, I am reading Andrew's books, watching the chatroom trades, and learning from the video trade recaps.

I intend to start my sim practice after the summer holiday when I have some quiet, alone time. I have a trading account here in Switzerland (Saxo Bank) which I use for other purposes. One of the first things I am doing is researching my options re: brokers and trading platforms.

The honesty and transparency of the traders in this community is truly inspiring, and I look forward to learning from you all. Hopefully, others can find something helpful from my experiences as I travel my own learning curve!

Jennifer (JenniferL in Chat)

-

looking forward to it!

.thumb.png.e6364d3c4b1c9a561e890bfed0424b4b.png)

.thumb.png.14ae29c2419c75af02b23bbc04042507.png)

Jennifer L. Day Trading Journal SIM

in Day Trading Journals

Posted

And so it begins