-

Content Count

835 -

Joined

-

Last visited

-

Days Won

111

Posts posted by Rob C

-

-

First let me applaud you on the discipline I see in your trading everyday. This is the toughest part of trading and when you have it the rest comes a lot easier.

My first question, are you making trading decisions on the 1min and 2min chart only? They are a little close in time frame. The 1min/5min or 2min/5min or all 3 is better.

So the first MU trade looks OK on the 1min. The MAs are moving up. Looks like an ABCD is being created so its OK the volume dried up a bit which it does commonly on the "C" part of the setup. I also like that it retested VWAP and still bounced higher. The only issue from the 1min chart is the 45.10 level is a REALLY powerful on being the PDC. But you have labeled it the same as the 45.05 level so it doesn't seem so strong. Sometimes I do enter a trade before the break of PDC so I can catch the move after, but only on volume. But here you were hovering under the PDC with low volume.

Then on the 2min chart things didn't look as good. The 200MA, which is heading downward is a strong resistance level. Unless your stop was tight and the 200MA is your target. Then on the 5min chart there wasn't a new high after the VWAP break, not giving you an entry point.

So I see why you took the trade, especially when looking at the 1min chart. I do recommend you have the PDC (previous day close) labeled a little different, unless you can still track it. I can't so I have it labeled differently. And I made the mistake of still using the 1min chart, as my primary well after the open. It took almost a year before it became comfortable using the 5min as my primary and the 1min/2min for confirmation and entries. Especially after 9:45am. So hopefully you won't make the same mistake as me and get comfortable using the multiple time frames early in your career.

-

2

2

-

-

Monday 10/14/2019

I had a well-being score of 6.5/10 this morning. I moved my fixed R to $10/trade while I figure out the sweet spot. High enough to feel the uncomfortableness of live trading, but low enough I will trade smartly.

Took 2 live trades this morning was with YNDX and FAST.

Backtesting showed AAPL and BABA are no longer in play at the open. Sadly there was enough data by last Wednesday to show this. I will backtest charts daily from now on and use the last 5 days (moving average) to determine the plan going forward. This would have save me two days of double stop outs. But, AAPL has made really nice 15min ORBs all last week and BABA still in play at the 5min mark. So Both stocks are off limits at the open. I can look at BABA at the 4min mark and AAPL just before the 15min mark.

YNDX and FAST were on my opening watch list, with MU and BABA on my 5 min watch list. AAPL was on my 15min watchlist.

My attention was entirely on YNDX at the open. I like it was the only stock I saw gapping up and it was gapping up more, with volume, right before the open. I already planned if it broke the 31.05 level with volume to go long. Which it did 2 seconds after the open. I usually wait a few seconds for the price fluctuations to settle down, but the L2 looked positive so I went long immediately. The priced spiked during my fill and I immediately lost 20 cents on the fill. For a $30 stock, it is pretty much game over. But since I was so close to the open I did go half share size. So my risk was still just above 1R and my R/R still OK. Too bad the price retraced back and I could have gotten a better entry a few seconds later. Live and learn.

So I was long YNDX a few seconds after the open with HOPM as my target and the daily level of 31.05 as my stop. Due to my bad fill it didn’t feel promising to take my first partial at 1.5R and instead I took 25% at 1R. The price than retraced and I was all out at B/E.

FAST actually setup while I was trading YNDX. Though I will take two trades at once with stocks I know well, I wouldn’t dare with these. After my YNDX trade was over, I did miss a move with FAST, but there was still a lot I liked about it for a 2min ORB. The candles were creating a mini ABCD and even though the stop would have to be far away, the 200MA-1min was right above my 1.5R and the PDC at 3R.

So I was long with PDC as my target and VWAP-1min as my stop. The price advanced quickly and I took a 25% partial at 35.85 which was a really strong level, since there was a daily level, HOTD and the 50MA-5min. Then the price moved higher and bounced really hard off the 35.93 daily level. So hard I took another 25% partial because I just lost faith in the trade. Then all out at B/E.

Then I did well in SIM. I took a 5min ORB on BABA which made it to 1.5R partial than out at B/E. I also took a SIM trade with AAPL for a 15min ORB which really ran.

Score cards (live trades).

YNDX

FAST

86%

95%

What I did good today: I like how I managed the FAST trade.

What I am grateful from today? +0.6R is not that much of a day, but it was a lot of fun trading new stocks.

What do I need to improve on: I will move my backtesting from weekly to daily. I just have to be careful not to make decisions on one point of data. Need 5 min. So I have to use the backtest data as a moving average.

-

4

4

-

-

I am almost at my 1 year trading live anniversary. Time to evaluate if it is worth continuing this journey. I was in SIM for 6 months, so I have been trying to learn day trading for 18 months. I always planned to access my progress and evaluate if I should continue at my 1 year live anniversary. It has been quite costly in time, so it is a serious consideration. Though I feel like progress has been made in my trading I don’t see any change in profitability, so it is not an easy decision. But with some reflection, this week, I realized it is better to look at this more holistically.

The change in my personality (for the better) has been dramatic. I would even say transforming. Especially, the last few months. I see improvements constantly and I would not want that to stop. Waking up at 5am and forcing yourself to face your fears, endure stress and muster the strength to make changes in yourself to improve creates dramatic results.

Let us say I went a different path and started working on starting a business. I would have worked on prototypes, a business model/plan, and presentations for funding. For the most part not stressful and no internal improvements would have been made. If I feel off that day, the worse thing is I program the 3D printer wrong and the part is thrown in the trash. If I feel off while trading I could go tilt and lose a large part of my family savings, permanently altering our lives. A much greater incentive for personal growth in the latter.

I like this growth in myself and I don’t want to stop. That alone it is worth continuing. Now if someone walked up to me and asked if they were training correctly, and they showed me my training plan for the last 18 months, I would say no. So way am I training this way? If you get a couch potato and you want to start training him for some track/field event, would you spend 10 minutes a day practicing in each decathlon event? No. But that is what I did. I set up my platform, and started trading different setups every day. Hoping I would get good at one of them. I would have recommended to the couch potato to first put the mileage in running. Then hit the weights. Improve your flexibility and get on a sensible diet while reading up on the events. So why didn’t I do that? And worse why am I not doing that now? Yes, I am trying to improve on some of that, but looking objectively I am still training wrong.

So first I listed what I should have done the past 18 months, find the deficiencies and then I will create an appropriate training plan. So here is my should have done list:

1

Education

Read enough to know you have a serious interest. Read enough to learn what next to read. Read enough to know what platform broker/SIM to use.

2

Get fit

Physically (exercise and diet)

3

Get Fit

Mentally (Decrease the incoming stress, able to handle stress and methods/activities to alleviate the stress).

4

Business plan

Do you have at least two years to learn? How many hours/week can you devote? How much disposable cash reserves do you have to cover expenses and losses?

5

Set up

Trading equipment. You can be frugal, but don't be cheap.

6

Training Plan

6 months SIM. Training during market hours and training after market hours. Mental and physical fitness should be part of the training plan. Also reading, webinars, etc.

7

Trading Plan

What time of day do you want to trade SIM, for how long? Chat on/off? Risk? Max loss? Max trades? These should all be decided in SIM

8

Learn the platform in SIM

Make a trade, partial and stop. Don't leave this phase until hotkey mistakes are <10% of the trades

9

Exploration phase

You need 3 trades in your playbook, though only one needs to be solidly profitable.

10

Dip your toes into live trading

Once hotkey mistakes are reduced and you have at least on setup in you playbook, you should go live at least once a week with very small share size

11

Discover trades that fit your personality

Nothing works? Or some setups do work but you are completely stressed when you take them?

12

Reread trading books, especially psychology

The books will mean more after being in SIM awhile

13

Revised trading plan

At least the last month of your trading plan should mimic your live trading plan

14

Choose 3 setups

Not just the one's that have worked the best, but the one's you feel the most comfortable taking.

15

Refine trades

You should be now taking trades like they are live. Once you do this you will see adjustments are needed.

16

Revised trading plan

This is the live trading plan, risk, max loss and max trades need to be written in stone

17

Revise Business plan

If not yet, trade losses need to be in your business plan

18

Go live 50%

I assume, in the beginning, you will hit max trades quickly then switch to SIM. Also make sure you take some SIM trades on setups you are still working on.

19

Work on nerves

Reread psychology books, they will make the most sense once you are live.

20

Test risk management

Even if you lose every trade, your losses should be manageable. If not work on risk management. Do not go past this step until complete.

21

Go 100% live

Once risk management is solid, go fully live.

22

Increase fixed R

Find the risk you are comfortable and slowly increase. Stay within comfort zone.

With that in view I didn’t even get through step 3. In the Van K Tharp course I am taking, they give you a test to check if you are ready to handle trading. There are essentially 3 parts. How much stress is in your life now (can you handle any more like day trading)? How well do you handle stress? Do you have methods to efficiently alleviate the stress? I failed this so badly I was below the bottom of the scale. So I should have known and fixed this 18 months ago. Now I have made progress and I do noticed my nerves are better when I trade. I have set goals to improve it and I have listed those in another part of the forum where I journal the Van K Tharp course I am taking. But this must be my top priority.

I am so glad I created a business plan or I would have quit when I started losing lots of money when I went live. Because I assumed I would have losses and had it in my business plan. Though I spent 6 months in SIM, I never really made it through step 8 (know the platform) or step 9 (exploration phase). I use to make 2 or 3 hot key mistakes a day. It completely disrupted my trading and was a big impact in learning how to trade. I should have spent all my time fixing the issue before moving on. This issue is fixed now and my hotkey mistakes are low, but that was a waste and caused undue stress. As for step 9, I left demo without any working setups. I tried and nothing worked. Then I chose the 5min ORB and heavily practiced it on DAS SIM and tradingsim.com with little improvement. I finally left demo just to try another platform to see if it would help my hotkey mistakes. It did.

I wish I did step 10. I do recommend it for new traders.

Step 19 took a while to fix (nerves). Rereading Trading in the Zone and Daily Trading Coach after you go live has much more of an impact. I tried reading lots of other books to help, I found most not useful. I did finally find a couple that helped. Essentially, I was raised that being negative was good. We would be punished as children for acting to positive, like we are jinxing the future. If we enter a task to positive and we fail my parents would love to tell us we ruined are chances because of the positive thinking. “Laugh before breakfast, cry before dinner,” was my parent’s favorite phrase. So this was a lot of programing to change. But, I have known lucky people. They enter the situation positively and assume things will go their way even though the odds are against them. And I watch how things go their way. So this mind set can really help in trading. You don’t second guess yourself and the ability to find setups is improved. There was actually an experiment that showed this.

To keep an open mind to different possibilities. If you think that something positive may happen, when an opportunity, though it may be outside the box, crosses your path, you would see it and act. I would be close minded and not see it. There is actually some data for this. I once read about an experiment where volunteers were gathered. One set of people considered themselves usually the lucky type and the second group considered themselves unlucky. Everyone was given a newspaper and asked to count the number of pictures in the newspaper. The unlucky group usually took 2 or 3 minutes to count all the pictures. The lucky group usually took around 10 seconds. Because the lucky group all noticed a big sign on page two stating, “there are 46 pictures in the newspaper.” The unlucky group were focused on just looking for pictures and never noticed the sign. You can imagine how that applies to day trading. So you need to make yourself luckier by using the power of attraction.

Step 20 (Risk Management). Ok, I think I got this one. I have not lost any money in the last 8 months trading live. My trading is not very good so it must be risk management keeping me afloat.

Step 21 (increase your fixed R). Definitely doing this one wrong. Essentially, I increase my fixed risk/trade, during profitable time, to the maximum I can handle without it affecting my trading. That’s not really the correct way to improve one’s trading. My fixed R is currently $30. If I go any higher the impact of a full stop out is too much to handle. Thus, I am at my maximum I can emotionally stand. But, it is still too high and affecting my trading causing bad habits. You shouldn’t choose the most you can handle you need to find a sweet spot in the training phase. If too little it feels like you are in SIM and you will trade too reckless. If too high you will trade to careful. So I need to lower my R. It will take a few tries to find the sweet spot.

So I am trying to determine my new trading plan. I will need at least a week to plan and experiment. I will have it fully implemented by my 1 year live anniversary. I have decided to give it one more year. If I still haven’t seen steady progress I am pretty confident I never will and should move on. The one thing that is certain, as in all changes for the better, things will get worse before they get better. Once I step outside my comfort zone and change things up, I will take losses again. I need to prepare myself for it. I have gotten quite use to not losing money.

Sorry this post was a bit long winded. Thanks for reading. Have a good weekend.

-

5

5

-

-

Friday 10/11/2019

I had a well-being score of 6.5/10 this morning. I was not able to trade yesterday due to power outages.

Took 2 live trades this morning was with AAPL and BABA.

I still like the daily charts and PM on both AAPL and BABA. I was long bias on both before the open. I essentially took the same trades I did Wednesday when I got stopped out on both. And today I also got stopped out on both.

Volume was instant for AAPL and a large hammer was created and I went long when the price broke the 200MA-1min. The only target above that price was the 233.49 daily level. But that is an R/R~1.7. My stop was the PM level of 232.65. I set a limit order at 1.5R, which was just below the target. Two minutes later the price missed my order by a nickel and retraced back to B/E, where I had a stop order to exit the trade for no loss. A few minutes later AAPL started its run up.

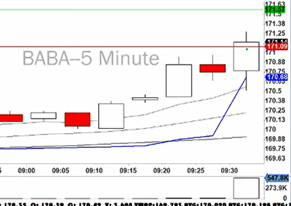

BABA had a really strong volume quickly and I really like the bullishness on the 5min chart with PM. I saw a L2 signal and a break of the 171 level that was resistance in the PM. I also liked there was a daily level 1R away that seems to pull the price up near the open. I had no good level for a target so I used 172, with my stop at 170.50. Wow, the price instantly reversed and I was stopped out in seconds. The one bad thing about the trade is I used the wrong share size. I saw the stop was 50 cents away but I used shares for a 35 cent stop. For some reason my stops coincidentally have been 35 cents for BABA for almost two weeks. So I think it was a reflex. But that stop now cost me an extra -0.5R. BABA did go for a run up later. Which is good because I have a swing trade on BABA.

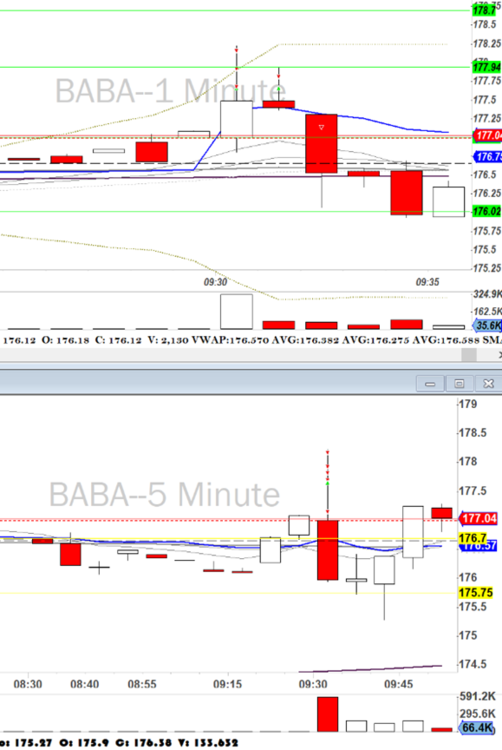

5min chart when I took the trade:

The total trade:

Then I took a few SIM trades for +2R profit.

Score cards (live trades).

AAPL

BABA

93%

90%

What I did good today: I like that I followed my new B/E stop out when price reaches 1R on AAPL. That is not easy for me. It’s difficult to S/O at B/E unless I take a profit.

What I am grateful from today? That the power outage didn’t last longer.

What do I need to improve on: I think I may move my backtesting from weekly to daily. I think AAPL and BABA stopped being in play at the open by midweek, but I kept trading them at the open. I just have to be careful not to make decisions on one point of data. Need 5 min. So I have to use the backtest data as a moving average.

-

2

2

-

-

A solid day trading!! Great discipline to stop while you are green!!

-

1

1

-

-

Thursday 10/10/2019

I had a well-being score of 6/10 this morning.

Took 2 live trades this morning was with AAPL and BABA.

Probably shouldn’t have traded this morning. I wasn’t planning on it because there were planned power outages to occur 4am. I woke up and there was still power and the outage was moved to noon. But I wasn’t in the right mind set and the usual nightly tasks to prepare were not completed. Adding to that I injured my food last night which I thought wasn’t bad. Then I saw how black and blue it was this morning and realized I probably under estimated the injury. Essentially, I was not in the right mind frame and should have skipped trading today.

Though the trades, on their own, do not look that bad. I have no memory of looking at SPY, L2 or T/S before I took either trade. Actually, I don’t even remember looking at volume before I took the BABA trade which is a must. So I consider this a bad trading day and it was not bad luck for my -2.3R loss today. I traded poorly and should have not even opened the platform today.

I still like the daily charts and PM on both AAPL and BABA. I was long bias on both before the open. Both stocks, especially, BABA were showing strength right before the open.

Volume was instant for AAPL and a small hammer was created and I went long when the price broke the HOPM. My target was 228 with the bottom of the candle as a stop. I usually like better stops this close to the open. The price immediately went against me and I was stopped out a few seconds later with a >-1R.

BABA had a really strong last 5min of PM and I waited for a pull back. An incomplete hammer was created and I went long at the bounce of the 165.20 level, with 165 as my stop and 166 as my target. There was volume, but honestly I didn’t check it at the time. Just like AAPL the price retraced immediately after I entered the trade and I was stopped out a few seconds later.

Got my head spinning to be -2R just after 9:31am and done with my live trading for the day. I did take a SIM short on BABA for +2R, but it didn’t really help my mood. I shouldn’t have traded today.

One note. PG&E are planning proactive power outages in my area to reduce chance of fire. I may not have power for 2 to 3 days. So if you don’t see any journal entry from me the rest of the week, you know what happen.

Score cards (live trades). I can’t really blame myself for the long bias, both looked strong in the PM. Not following my entrance checks were my main errors.

AAPL

BABA

85%

88%

What I did good today: Took a good SIM trade.

What I am grateful from today? Stopped trading at 2 trade limit

What do I need to improve on: When not to trade when you don’t have the right mindset.

-

3

3

-

-

Tuesday 10/08/2019

I had a well-being score of 6.5/10 this morning.

Took 2 live trades this morning was with AAPL and BABA. I like my trading today.

I really like the daily charts on both AAPL and BABA. Either could break high (AAPL) or low (BABA) or bounce from the resistance/support. Thus I had no bias in the direction of either stock.

The volume arrived quickly on AAPL and about 20 seconds after the open a nice hammer was formed. I went long with PDC as a target and a reasonably large stop at the bottom of the candles wick. This was a R/R~3 which tends to be too high for an opening trade. I sent a 50% sell order at 1.5R and waited. The price went to 0.8R and stalled and I noticed SPY was dropping hard. I was nervous about being S/O so I sold 25% shares at 0.8R. I only had to wait 15 more seconds and the price reached my 1.5R limit order. Ten the price retraced fast. I was nervous about the price dropping faster when it broke the 226.08 daily level so I sold the rest of the shares before B/E. And as usual the price reversed to the penny of my stop and went for a big run without me. But, I still liked the trade and happy with my +1R. Much better partialing than I usually do.

A few seconds after I entered the AAPL trade, BABA setup as well with a hammer, good volume and semi strong levels to help pull the price through. I went long with the 165.51 daily level as my target and VWAP as my stop. I immediately set my 1.5R limit order and the price jumped up and touched it without filling it. Then reversed quickly. By a rule I need to stop out at B/E which I did and was quite proud of myself for doing it . Yes the price reversed a few cents after and reached my 1.5R target but I am still glad I followed my plan.

I had to take my eye off the BABA trade since I was going to stop out of AAPL and I thought the BABA trade was over. But since I had to move my attention quickly over I did not get a chance to cancel the BABA order. The price jumped and triggered the order, which is now a short. After my AAPL trade I noticed I still had an active BABA trade. I first thought I didn’t sell all the shares and hit the sell all button. But trade was still active. The same moment I hit sell all again I realized I am short and doubling my shares. I quickly covered. Now for the last 18 months (live and SIM) I have NEVER had a hot key mistake go in my favor. So it was a surprise I saw a +0.7R profit from the mistake.

Now this is significant. I spent my life a very unlucky person. I am also a very negative person. Until recently I didn’t know they were related. Recently, I have tried to be more positive and I have noticed that once in awhile now luck is on my side. Though very cool, it is very disorienting. So I assume this hotkey mistake in my favor is a continuation of this. Again. Very cool.

One note. PG&E are planning proactive power outages in my area to reduce chance of fire. I may not have power for 2 to 3 days. So if you don’t see any journal entry from me the rest of the week, you know what happen.

Score cards (live trades). Does not include hotkey mistake trade.

AAPL

BABA

92%

93%

What I did good today: The new partial profit plan is working out well

What I am grateful from today? Made profit on a hotkey mistake.

What do I need to improve on: Need to create a B/E stop hot key this week.

-

2

2

-

-

Monday 10/07/2019

I had a well-being score of 6.5/10 this morning. Back to a 2 trade/day limit.

Took 2 live trades this morning was with AAPL and NVDA.

I really like the daily chart on AAPL. Looks like it may make a break higher. Also good PM. NVDA was also in play so they were my two focuses at the open. MU, ROKU, BABA and AVYA were placed it on a side charts.

AAPL immediately got volume, dropped and bounced off the daily level (226.08) and created a nice looking hammer. Volume was good and I liked the 200MA-1min ~1R away to help pull the price up. I went long with PDC as my target and a reasonable sized stop at the 226.08 daily level. R/R ~ 2.5R

What the chart looked like when I took the trade:

The price hovered around my entry for about 30 seconds then headed south with SPY. I tried to stop out at the daily level but got a huge slide making it a -1.5R loss. Then the price reversed an instant after my stop and headed back up. The price didn’t reach my target but did reach my 2R profit so it was a bit irritating. The chart below also shows my 2 SIM trades with AAPL afterwards, which I was stopped out on both.

The volume for NVDA arrived not to long after the open but the price did not move for awhile then jumped after about 40 seconds from the open. When the price broke the HOPM I went long with 187 as my target with a scary tight stop (HOPM).

I immediately hit my 1.5R limit order hotkey to try and help have patience. It was about a 30 second wait, then the price moved up and my 50% share order was filled. Then I took another partial (25%) at 2.5R with not the best fill. Then held the last 25%. I don’t have a stop at B/E hot key setup yet, but I will set that up tomorrow afternoon. If I waited to the exact B/E, the price would have reversed and made it to my target. But I am still happy with this trade. I tried a SIM trade afterwards and was S/O. I should have waited for a better entry.

Score cards (live trades).

AAPL

NVDA

90%

91%

What I did good today: Waited patiently for my 1.5R order to fill on NVDA.

What I am grateful from today? My NVDA trade was slightly larger than my AAPL loss with a big slide. Grateful to trade something new.

What do I need to improve on: Need to create a B/E stop hot key this week.

-

2

2

-

-

Nice trade. Great way to end the week!

-

1

1

-

-

Friday 10/04/2019

I had a well-being score of 6.5/10 this morning. I am limited to 1 live trade a day due to 3 big loss days in a row, broke a rule and a general lack of discipline.

My 1 live trade this morning was with MU.

AAPL was definitely in play. MU PM looked a little better than BABA so MU was my second focus. I also liked AVYA and placed it on a side chart.

Both AAPL and MU opened weak. According to back test data APPL does not trade well from a standard 1min ORB. You need a hammer (or reverse) or a pull back. AAPL did not give those signals so I didn’t trade it. Though today a standard 1min ORB would have done very well.

So I took a standard 1min ORBD with MU. Though my mouse curser was 2 screens away from the montage. So by the time I was able to click the short key I lost about 5 cents. But I saw this and took small share size to compensate. My target was the 43.36 daily level and VWAP as my stop. This was a green to red play, but PDC was coupled with the 200MA and a tech level. The price tried to break these levels twice and failed and I was stopped out for -0.7R.

I quickly switched to SIM and shorted MU when it made another go at PDC. It broke through this time and I set a limit order at the target of 43.36. My stop was really tight using the 43.54 daily level. Setting limit orders on my SIM trades this week has gone well and has helped my patience. My order was filled and I took another partial, then exited when it was threatening PDC again.

At the same time I took a SIM trade with BABA. It was essentially an early 5min ORB and I got a bad fill. But the trade went in my favor quickly and I sold half my shares to reduce the risk. Then quickly sold the rest when the price stalled. I went short again 30 seconds later with a better entry and again I set a limit order at my target and waited for it to be filled. Its funny how good BABA has traded the last two days, since it was the only two days in weeks I was not looking at it at the open.

Score card (live trades).

MU

87%

What I did good today: Traded something new. Kept to my 1 trade restriction.

What I am grateful from today? Did well on SIM trades again today (+3.7R)

What do I need to improve on: Will try limit orders next week on live trades.

-

1

1

-

-

Van Tharp Institute Peak Performance Course for Traders

Vol 3: How to Control Losing Attitudes

Chapter 3

Finally finished this monster chapter. Huge exercises. The course said it will take up to several weeks to finish the chapter. It left me a little unsatisfied because the whole chapter is really taking tests and created huge lists, but the analysis will come later. So I am not sure why I did all this work yet.

The last part of this chapter that needed to be completed was to combine and prioritize the two previous value lists into a 200 long list. Then there were two tests, which will be evaluated later, so I won’t mention them yet. Finally another list of what trading means to you which will also be analyzed later.

So here is the combined value list. The essential to have and what you must avoid in one list. It is interesting the list gets very “block” like the bottom half. As a whole category of values will be less important than another.

Value

How do you know when you have…?

How do you know when you DON'T have…?

Love

Feel alive

Void

Spending only 15 days/year with my family

Little to no bond

My kids will spontaneously hold my hand

Every night I regret not spending more time with my kids that day

Go to sleep with regret

Fall asleep quickly

Spending time with my family

Feel the bond

You feel the bond with them slipping

Watch my kids grow

Catch the milestones

Miss the milestones

Happiness

Look forward to the day

Dread the day

Make your child laugh everyday

Best sound in the world

I can tell there was something missing that day

I will finally have time, when my children are too old to care

They prefer spending time with their friends

They go out of their way to spend time with you

Realize it is too late to build the bond you wanted with your children

You try to bond with them but there is no foundation

The bond builds

Having to say no when they ask for you to spend time with them

Feel the guilt

They still ask, knowing there is a possibility you will say yes

Trust

Run to me when they are upset

Avoid me

Vacations

Immediate increase in bond

Burn out

Missing milestones

You see the milestones only on video

You are the one recording it

They prefer playing video games than spending time with you

You only see your kids behind an I-Pad or computer screen

They stop playing computer games to say hello to you when you come home

You lose touch of what their favorite things are

They surprise you when you think you are buying something they like

You know what they would like

Reading to kids

They look forward to it

If you haven't read to them in awhile its awkward

Traveling

The kids talk about for months afterwards

They will ask for it everyday

Help kids with homework

They are less stressed about school work

They are stressed since they feel like they are on their own

They suddenly look taller

Self explanatory

You know what roller coasters they can ride on

They suddenly stop calling you daddy

You become dad

There is still a loving charm in their voice when they call you daddy

Safety for other drivers

Stay alert while driving

Risk of falling asleep while driving

Safety for my passengers

Stay alert while driving

Risk of falling asleep while driving

Unsafe to drive

Fall a sleep at the wheel at least once a week

Chance of falling a sleep while driving never an issue

No energy

Very difficult to complete any task

Even have strength to exercise

Safety for myself

Stay alert while driving

Risk of falling asleep while driving

No focus

Hours go by and you didn't accomplish anything

Feel like you accomplished a lot by the end of the day

Dizzy spells

Have to grab on to things especially after standing up

I can safely help tie my kids shoes

Catch colds easily

If anyone in my family has a cold I have it a couple of days later

I can safely take care of my sick family member without much concern

Procrastinate

Difficulty starting the task

Completing my to do list

Always irritable

Family keeps their distance

Able stay clear and calm

Way too much caffeine

4 double expressos, to keep going, is common

< 3 standard coffee/teas a day

Memory strength

Surprise people with my memory

Forgot why I walked into that room

Work effectively

Stay ahead of the game

Seems like there are not enough hours in the day

Keep up with the kids

They tire first

I tire first

Don't fall asleep while standing - I hate that

I don't dose off during the day

Fall asleep anywhere

Prevent dizzy spells

No dizzy spells

Almost faint during the day

Strength to exercise more

Exercise more than 3 times a week

Unable to exercise

It would be nice to yawn again. You body turns that off during long extreme periods of sleep deprivation. I haven't yawned in 10 years

Yawn like a regular person

Forgot what it was like to yawn

Acid reflux from too much coffee

Need tums or food to reduce reflux, though I am not hungry

Not a concern

Fall asleep while standing

You never know when or where you may dose off

Not worried about falling a sleep during a meeting

Dread each day

Don't want to get out of bed

Spring out of bed in the morning

Unable to focus

Only think about what worries you

You can focus on the task at hand

Keeps you up at night

Wide awake at 3am even though your exhausted

Fall asleep immediately

provide for family

They go without wanting

Cutting expenses

Sustenance

Pay the bills

Loss of basic necessities

Better secondary education for my kids

Kids happy with their school

Not happy, poor scores compared to national level

Simple issues now look big

Always worried about something

Take life as it comes

Want to ignore difficult tasks/issues

Everything seems insurmountable

Able to approach tasks

Inability to trade due to nerves

Take poor setups. Don't let winners run.

Patiently wait for setups

Always feel on guard

Can not relax

Feel safe

Heart pounds

Heart pounds to a point you are scared of your health

Breathing exercises is enough to clam yourself down

Different stresses are cumulative

Things add up during the day until a limit is reach, where you just shut down

Able to keep the stresses separate and in check

Hear turns gray

Its amazing, during stressful times, how fast your hair turns gray

Gray with age

Intrigue

Enjoy learning about the financials

Not even knowing the Nasdaq current level

Need

Have the materials to function

Don't have the basics, effects work

Financial freedom

Able to pursue more interesting work

Work for a paycheck

self-worth

Feel good about yourself

Feel the stress of not providing as much as you should

College fund

Staying with the needed savings plan

Worried how we will pay for it. Limiting my kids choices

Success

Created more than enough income

Not even following the right path to succeed

Fascination with markets

Eager to trade in the morning

Dread trading

Nothing to wake up for

Not easy to get before dawn for work

Spring out of bed in the morning

Difficult to find a meaning in life

You look but you can't find one

You know your role in this life

Not a good role model for kids

Scares me they might stop dreaming of the future

They tell me often what they want to do with their lives

Difficult to plan the rest of your life

You don't see the light at the end of the tunnel

You know your plan

No motivation

All tasks become difficult

Able to get yourself going

No meaning

You question why you do anything

You know why you do everything

The days have no distinction

All days become a blur

Everyday has a distinct meaning and memory

Forget things easier

When things have little meaning they are forgotten faster

More meaning more remembrance

Difficult to be happy

happy moments are brought down, because you ask why for everything

You can live in the moment

No path, no direction, meander

Difficult to make decisions when you have no directions

Decisions become easier

Panic that you will never find another job, at least at that level

You feel you and your knowledge is too old

You get calls from head-hunters very few months

Feel worthless

All your other accomplishments no longer seem significant

You know and can list your accomplishments

You start thinking about just getting a paycheck instead of a career

You don't care about accomplishments anymore

You get your projects done

Feel regret that you did something wrong to get laid off, even though thousands did with you

Can actually list reasons why, even though they are likely not a factor

No regrets, you move on with the opportunities awaiting

Question you career path

Wonder why you spent all those years in grad school and this job

You know it is a temporary directional change

Question the worth of your education

You could have been in the same situation without working so hold in school

You never forget the positive changes education has done to you

Lack of respect

Feel like a loser

You always respect yourself

Avoid conversations with people you haven't seen of awhile

You plan your day around avoiding people

Actively approach people

Life goes on hold

Mental block to plan any future event

You don't defer your plans

Even when you have steady employment, once laid off you always think you can be again.

Never think you have job security

Create a plan B and always have it in your pocket

Always tired

By noon you are just planning when you can get to sleep

Never slow down during the day

No stress relief

Stress builds

Working out reduces stress efficiently

Poor focus

The day seems to pass by without getting much done

Getting stuff done

Can not keep up with my kids

You start to watch them and not participate

You run them into the ground!!

Chronic pains arise

Seems every day a new pain

A pain once in awhile but its easily walked off

Unable to day trade

You lack it all the focus, the stress, the discipline and the patience.

Boy does it help.

Feel old

I always feel 10 years older when I am not fit

I don't think about my age much

Get injured easier

I just walk down the stairs and by the last step something hurts

Go running, hiking, or lift and it is not a concern

Lack of a hobby

there is a void in your life without a hobby

It great that exercise can double as a hobby

Headaches

They always start about two weeks without a good workout

I can go years without a headache when I am fit

Livelihood

Job more than a paycheck

Just a paycheck

Life Goals

"Never work a day in your life"

Job inspires no goals

Challenging

Creates interest to learn and adapt

Robotic

Fulfilling

Job fills at least one goal

Job does not fulfill any goal

Responsibility

People trust that you will complete the task

Checks needed for you

Role model for my children

You inspire them to do something they love

A job is just money

Team player

No one has to fight for credit

Free for all

Make use of education

PhD = Doctor of Philosophy

PhD = Pizza Hut Delivery

Part of something big

More like a quest

Just see the day to day grind

Pride

Proud to say what you do

Refer to yourself generically as an "engineer"

Feeling needed

People depend on you every day

Your not missed

Trusted

Answers/tasks are accepted without question

Always questioning you

Valued

Fell irreplaceable

Easily replaced

Missed

They feel glad when you returned

They had not noticed you were gone for a few days

Respected

Your opinion matters

Your thoughts are not worth anything

Self Esteem

You simply feel good about yourself

You feel like a disappointment

Achievement

Something recent that you are proud of

If you have to go back far in time to your last achievement

Make a contribution

Feel that others benefit from your help

Doesn't matter if you were there or not

Knowledgeable

They seek out to answer questions

Your opinion does not matter

Helpful

They expect that you will offer help and are grateful

Feeling needed

People depend on you every day

Your not missed

Trusted

Answers/tasks are accepted without question

Always questioning you

Valued

Fell irreplaceable

Easily replaced

Missed

They feel glad when you returned

They had not noticed you were gone for a few days

Respected

Your opinion matters

Your thoughts are not worth anything

Self Esteem

You simply feel good about yourself

You feel like a disappointment

Achievement

Something recent that you are proud of

If you have to go back far in time to your last achievement

Make a contribution

Feel that others benefit from your help

Doesn't matter if you were there or not

Knowledgeable

They seek out to answer questions

Your opinion does not matter

Helpful

They expect that you will offer help and are grateful

Creative

Positive responses for your "new" ideas

Rehashing old ideas

Continually improve

The world opens to you

Same old, same old

Read

Every day (audio books)

<4 a week feels like I am no longer reading

Learn new

Learn something new everyday

Can't remember the last thing learned

review old

Almost always recall useful info

Always unable to find useful info not recently learned

Increase understanding

Instinctively always want to know the "why"

Learn enough to finish the project

New skills

If you are struggling, you are learning something new

Everything is too easy

Learn Day Trading

Improving each month

Stagnating

Stay with new tech

You find yourself teaching other on the new tech

You see others using new tech and you have no idea how to use it

Keep a good memory

Surprise people with my memory

Forgot why I walked into that room

De-stressor

Tolerance for stress is high

Easily set off

Hobby

Working out is fun

Hitting the gym is a chore

Keep fit

You can feel fit

You can feel out of shape

Improve sleep

Deep sleep more than half the night

Light sleeping only

Improve mood

High tolerance

Short fuse

The great Outdoors

The reason I moved to California

What a waste moving to California

Time to myself

Then like to spend the rest of the day with people

Feel claustrophobic

Push myself

Proud of the workout

Felt like I wimped out

Time in the sun

Good day sunshine

Vampire

I want to climb Mt. Whitney

Ready for Whitney in 2021

Will I ever be ready for Whitney

Calm

Zen

On the edge of a mood swing

Mediation

The skill is getting easier

Not seeing any progress

Contentment

Living a worthy life

Going to die with lots of regrets

Quiet

Hear the roosters and cows

Hear only shouts

Time for myself

Take the short way home

Take the long way home

Interim between stressful events

Back to norm before the next event

Fires keep building on each other

Music

Listening to my daughter play piano

The day just doesn't seem as harmonic

Walks

Listening to books or bonding with my son

The bond with my son seems to drift

Pets

Unconditional love

Like something is missing

Sleeping child

Nothing more peaceful

I miss not seeing them sleeping in the mornings

Work less efficient

Always need to look back on what you were doing

You have an outline in your head that you can easily follow

You can feel it is getting worse

Less work done each day

Can see improvement with normal daily activities

Forgetting memories of your children when they were young

See an old picture and can no longer remember the event

Don't need to see pictures since you can recall the event clearly

Thinking you peaked some time ago and now just falling

You haven't accomplished what you wanted in life and now it is too late

Your making progress and there is still time

You extrapolate the worsening of the memory loss and think you will be useless by 65

You can't imagine providing for your family in a few years

Will be working until at least 70. NP

Difficulties trying to prevent it

You try the gimmicks and nothing works

Just the usual healthy living and you see it improve

Need to look up things I use to recall

Seems like that's all I do all day is look things up

I can just recall them. Very efficient

Can't remember why I walked into a room

I hate that, it is a constant reminder that you are losing your memory

You definitely notice when you stop doing it

You work with people who had a much worse memory than yours and now theirs is better

Nothing hits you more when you see this

You are the one in the meeting tat has the info at your finger tips

Hopes of getting another degree fade

I love learning. It hits you hard when you think you are no longer able

Still plan to go back one day for more learning

Anger

You feel immature

Nothing brings out the immature child in you

You pause with adult like control

Regret any action under the influence of anger

Once I calm down I am so regretful of losing my temper

It helps control my anger knowing I will regret it

Don't act like yourself

Its amazing who you become when you are angry

Stay yourself

Lose control

You become unpredictable

You control and determine logically what the next step is

My children are learning to have a short fuse

It is awful to see them copy bad behaviors

I make an effort to show how to deal with emotionally stressful times

Get other's angry

It is contagious

I rather put out the fire than spread it

Makes the world look last inviting

You think anything will set you off

The rest of the world is unrelated to your issues

It gets worse if not managed

It builds until anything will set you off

It is managed, forgiven and you move on

You forget what even got you angry

The anger lasts longer than the issue it self

The anger dissipates quickly

Hold grudges for a long time

I can hold a grudge for the rest of my life

Forgive and move on

Financial Worries

Difficult to plan your family's future

You feel guilty planning anything

Always planning and setting goals

Huge stress factor

You find your heart pounding and stomach growling for no reason

You have other things to think about

When its bad it dominates all thoughts.

You can have this stress on the front of your mind all day

You don't think of it

Disappointment as the primary family provider

It doesn't get much worse than that

You feel that you are providing well for your family

Money is leaving your accounts faster than it arrives

You see it every month when you pay the bills

There is financial stability

All expenses are now under scrutiny

The littlest thing now has to be a decision if to spend or not

You don't sweat the little purchases

Savings for college fund and retirement stop

You start thinking pay check to pay check

You save and invest

Your children don't understand when their friends go on extravagant vacations and they don't

It hurts

They have enough vacations they are not bothered by them

People start to think you are driving that classic car to be cool. And not because you can't afford a new one

You don't correct them

You buy a new car

At its worse it seems like everyone you know is buying a new car or house.

You seem to notice those things now

It is not more common than usual

Messy Life

Unorganized

Don't even seem to have the materials to get organized

Folders, binders, calendars, cabinets, etc. are all available

Finishing things at the last minute

Its difficult to start when you know the first thing you need to do is find stuff

The things you need to start are handy

Messy house

Messy hours equals messy life

Clean house means clean life

Postponing tasks

Don't want to start working in this mess

Start tasks promptly. Have a daily task lists created

Not easy to find something

At least 20% of the task is looking

Not a factor in the task

Inaccurate personal calendar

Can no longer trust the calendar

Can't live without the calendar

Need to be reminded about appointments

No calendar, no schedule

I usually remind others

Delaying doctor's appointments

Just another thing to add to the list

They are important

Not Feng shui

Yikes! You can feel the energy sucked away from you trying to walk through the house

The house provides energy

Overdue library books

That goes without saying

Always check what is due

Then the course asked to make two lists. Firs list what trading means to you and the second list what others have told you about trading.

The Meaning of Trading

Hope to help my family's future

May give me more financial flexibility

Exciting

The effort improves my psychology

Learning the training skills keeps my mind sharp

Forces me to learn how to better handle stress

More in tune with world financial situation

Discovering my weaknesses

Fixing my weaknesses

Investing 15-20 hours a week of my time

Always wondering if I have what it takes to be profitable.

What others have told you about trading

It's hard

It's easy

Everyone has a stock they are recommending

Everyone wants to know what stocks you are investing in

Your going to lose all your money

Only the Wall Street professionals with the resources can be profitable

-

1

1

-

-

Thursday 10/03/2019

I had a well-being score of 6/10 this morning. I am limited to 1 live trade a day due to 3 big loss days in a row, broke a rule and a general lack of discipline.

My 1 live trade this morning was with TSLA. Since I am restricted to one trade I was hoping to trade something different.

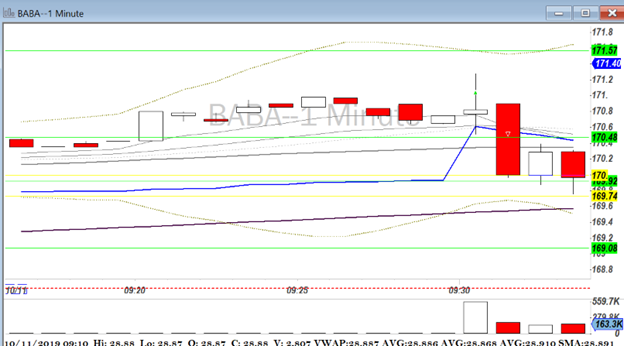

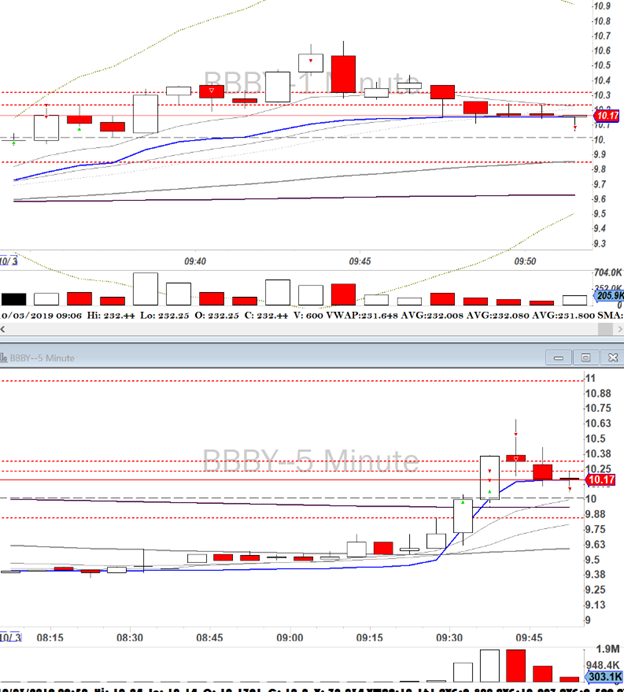

Though I was hoping to trade something new, AAPL still looked good in the PM so was one of my top 2 focuses. TSLA was definitely in play. I liked GPRO but Centerpoint did not have shares to short. BBBY looked good so I kept an eye on it on a side chart.

TSLA opened weak and I was watching for a pull back to VWAP. I missed it since I was looking at AAPL and BBBY at the same time since they looked about to setup as well. So I shorted TSLA on a standard 1min ORBD with the break of the candle body. My target was quite far away at the 227.89 level that is not even on the chart below. And my stop was VWAP. Not that pretty of a setup but a huge R/R so it was worth a try. I went half shares knowing TSLA can smash right through your stop and give you a -2R. Just as I entered the trade with TSLA both AAPL and BBBY both setup. But I have a one trade limit so I just had to watch them. The price quickly retraced and I was stopped out with a huge, but expected, slide. Since I went half shares I only lost -.8R. Though my target was far away, the price did drop and reach my target 20 minutes later, showing it was a good calculated risk.

I quickly switched to SIM since I wanted to catch TSLA if it setup again. But instead I saw a setup on BBBY.

BBBY open strong and created a mini ABCD inside the 5min candle. Essentially this was a 5min ORB that I took a little early because I thought it may pop if it goes red to green. My target was 10.24 level with 200MA-5min as my tight stop. I tried something new. I am really focusing on taking partial profits better. So I pressed a newly created button which sent a limit order at 2R to sell 50% of my shares. Since 2R is right at a level it was a really strong spot to aim for. Then I sat on my hands. I would have likely taken 4 partials on the way to my target, but with the order already in (and in SIM) I was able to wait and get my order filled. Shortly after I saw something scary in the T/S, though I do not have a recording of it so I can’t go back and check what it was. But it was enough I got all out.

The price dropped then the signal disappeared and I got back in at a lower price with a slightly higher target and PDC as my stop. I waited patiently and took two heavy partials then all out at B/E. Another button I set up to place a stop at B/E. I have been getting out to early. A nice +4R winner.

Besides traded something new, using some new hotkeys, I also decided yesterday to look at my P/L every day (after trading was finished). The month without it helped me get my mind a little more focused on the training not trading aspect. But, it is also counter productive. I still need to know my P/L to help evaluate my trades. And I was instinctively estimating my P/L anyway which takes longer and is a waste of time.

Score card (live trades). Using the new scoring:

Original

New

Setup

50%

25%

Entry

20%

15%

Partials/Exit

20%

50%

Share Size

10%

10%

Total

100%

100%

TSLA

89%

What I did good today: Traded something new. Kept to my 1 trade restriction.

What I am grateful from today? I really like the 2R limit order button.

What do I need to improve on: Keep trading different stocks in play. Maybe wait for the break of the wick on 1min ORBs if the end of the wick is close.

-

2

2

-

-

Welcome Mark, great trading for your first day. Actually I like your TVIX setup and entry, though that was a really tight stop you had. Since I would have treated it as a 10min ORB I would have probably used the 5min VWAP as my stop.

Your SFIX partial profit taking looks fine. Actually it's better than mine. You took your first partial at a tech level, and yeah it would have been good to take more profit at the 18.40 tech level, but maybe you were low on shares and wanted to hold for a longer run.

As for position sizing, most of us are big fans of shares calculated by risk R. We determine a fixed risk per trade that we are comfortable with. Mine is currently $30. Then you determine how much risk you have in that trade, say your entry is 10 cents away from VWAP. (your stop). Then to only risk $30 on the trade you would take 300 shares. So with 300 shares, and you sell at your stop, you would lose $30.

This fixed risk per trade is the 2% Andrew describes in his book. Not the entire cost of buying all the shares. So my example above with 2% of your account as your risk and your account is $5000 (account size not buying power). The fixed R you would use, $100 risk per trade. If you your risk on the trade (distance from your entry and stop) is 10 cents, you would purchase 1000 shares. That's too rich for me at the moment.

Andrew, more recently, has recommended 1% risk per trade now.

-

Wednesday 10/02/2019

I had a well-being score of 5.5/10 this morning. I am limited to 1 live trade a day due to 3 big loss days in a row, broke a rule and a general lack of discipline.

My 1 live trade this morning was with AAPL. It left me a bit spinning. Starting to feel better now.

AAPL as my primary focus. BABA was also on my market open watchlist with MU and NFLX was on my 5min ORB watchlist. It was odd but I liked AAPL, MU, and BABA from the premarket and wasn’t sure which to focus on. At the last minute I chose AAPL and BABA really for no other reason then it is much easier to watch that combo than say AAPL and MU due to different prices and personalities.

AAPL open with good volume and bounced of the HOPM. I decided to go long if it broke that level. Since I was a bit short bias I knew this trade would probably be a fast scalp so I did jump the gun a bit and entered the trade before a clear break. My target was 224 and stop 223. But in less than a minute it made a clean break and I took one partial. The price quickly retraced and I got stopped out.

But this is where the emotional strain hit. Before I got stopped out I was thinking this looks like a really good short, so my instinct was to flip my position well before my stop. But I can’t because I am currently on a 1 trade/day restriction. So instead I held onto the position longer to a full –R. I tried to switch to SIM quickly and take it short, but it took to long and I felt like I was chasing it so I didn’t.

I was already feeling low after the AAPL trade, then worse after my SIM trades. I first took two SIM trades simultaneously. One I was stopped out by 2 cents than the stock went for its run without me. The other stock I did get two partials than I was stopped out by a penny and then it went for its run without me. Then I started to overtrade (on SIM) and took 4 poor trades and got S/O on each one. Which forms more bad habits.

That’s when I felt my lowest. But about an hour later is when I realized that the main reason I am forcing myself to one trade/day is punitive. If I go back to SIM, that is like a vacation to me. But I really need to feel the pain for breaking one of my rules on Monday. And today was a perfect way to solidify that. It hurt not being able to flip the position. And I will likely stay on the one trade restriction for the rest of the week.

I also decided to take advantage on the remaining two days this week. Since I am on a one trade/day restriction I can do less damage. So I should be experimenting with different stocks and setups. Data I took, a few months ago, is that my win% was much better on stocks that I know well. But that was a few months ago. I may be a better trader now. So I decided to trade stocks in play that I like for the next two days.

Score card (live trades). Using the new scoring:

Original

New

Setup

50%

25%

Entry

20%

15%

Partials/Exit

20%

50%

Share Size

10%

10%

Total

100%

100%

AAPL

89%

What I did good today: Stayed on the 1 trade/day restriction, though FOMO was high.

What I am grateful from today? That I did recover from the FOMO. Though it took a couple of hours.

What do I need to improve on: Will take advantage of the trading restriction to trade stocks I usually don’t and try to learn from them.

-

2

2

-

-

Very impressive how you caught the whole move on AAPL. That's a lot of discipline to only take profit at tech levels.

-

1

1

-

-

Tuesday 10/01/2019

I had a well-being score of 6.5/10 this morning. I am limited to 1 live trade a day due to 3 big loss days in a row, broke a rule and a general lack of discipline

My 1 live trade this morning was with AAPL. I learned a lot today.

AAPL as my primary focus. BABA was also on my market open watchlist with MU and X was on my 5min ORB watchlist.

Based on back test data MU should be my primary focus, though it can be switched with AAPL depending on PM. I really liked the PM of AAPL today (gap up 0.5% and lots of vol) and its daily chart so it became my primary focus. BABA had a nice daily chart so I also prioritized it over MU.

I was long on AAPL so I was glad to see it drop at the open with lots of volume. So I waited for the reversal and hammer to be formed. Near the close of the first 1min candle a nice hammer was forming. I went long a little bit before the hammer was fully formed since it broke through the 200MA-1min. My target was the 226.08 daily level and my stop the 224.9 PM level. The R/R =4 which is too high for these 1min ORBs. But since I expected a slide on the entry and stop I used a larger 35 cent stop. This made the R/R~2.5 which I felt better about.

So today was interesting. Though my nerves have been much better the past 2 months, today I was especially calm before the open. So when I started to get stressed in the middle of the trade it was wasn’t as bad as usual and I actually remember taking each partial profit and what I was thinking. This is important to analyze how to improve my trade management.

AAPL had a 8R move, from my entry, in 20 minutes. From my entry to the last shares sold I caught a 3.3R move. But I had so few shares left I felt like not holding them by the end. And though I don’t look at my P/L anymore, I can estimate I, at most, made ~1.5R in the trade. So again I let the trade that could of made my month or at least my week, go with just an OK profit.

The first move up was reasonably quick and I took a tiny partial (1/8). Then over the next two minutes I had my finger on the sell all button as the price jerked up and down and tested the HOTD 5 times. On the 6th time I lost faith in the trade (even though the candle created another hammer and SPY was going up) and I took a ¼ shares profit. The price moved up 2 seconds after. Yes I didn’t know that, but I made so little taking ¼ shares at a 20 cent move. I should have saved them. If I did not take that partial and took all the other partials at the same spot, this would have been a 2.2R trade. A big difference.

The price then moved quickly and reached my first real partial profit target HOPM. Where I took a partial. Then the price tested that level 3 more times over the next 2.5 minutes. Now my finger has been on the sell all button for 5 minutes, ready to spring into action. So finally the price broke the HOPM. This is where you sit on your hands and watch the price move up. But after 5 minutes on edge, thinking I need to exit at any second, I took two reasonably sized partials for almost reason. The one thought I had at that moment is AAPL tends to give you about 60 cents on these 1min ORBs, so I had the feeling I should take a partial there. Taking two there was just due to nerves. The price finally reached my target, with little shares left and I partialed a little early. Then with very few shares left I sold the rest at the next daily level. Where I also sold a little early compared to that level. So 7 partials and 3 of them there was no need. But that 2nd partial was the most costly.

Score card (live trades). Using the new scoring:

Original

New

Setup

50%

25%

Entry

20%

15%

Partials/Exit

20%

50%

Share Size

10%

10%

Total

100%

100%

AAPL

91%

What saved my score today is at least I held on to those last few shares until the next tech level.

What I did good today: Great entry.

What I am grateful from today? Was especially calm before the open.

What do I need to improve on: Need to be stronger not taking partial profits in between the tech levels.

-

2

2

-

-

Monday 9/30/2019

I had a well-being score of 6.5/10 this morning. Wow 3 really bad loss days in a row.

I took 3 live trades this morning with AAPL and BABA

AAPL as my primary focus. BABA was also on my market open watchlist with MU and JD was on my 5min ORB watchlist.

Based on back test data MU should be my primary focus, though it can be switched with AAPL depending on PM. I really liked the PM of AAPL today so it became my primary focus and I wasn’t too happy with the SSR on MU. BABA gapped up with vol so was also on my market open focus.

As BABA had no volume right away. So I was focusing on AAPL which gapped up 1% with vol in the PM and I was definitely long biased. There was a really strong level at 220.95 that was strong resistance in premarket. Once after the open this level also created resistance, so I was waiting for a break to go long. Since the previous test punched through and back by 10 cents I was waiting for a solid break before going long. It didn’t take long and I entered the trade. The fill was bad but that was predictable. My target was the 222 level and my stop was the bottom of the candle. I guessed there would be some slide and gave it a 35 cent stop which was perfect.

I took a tiny partial profit (1/8) due to nerves then took another at my first real level. At first I took a small share size profit. Then I remembered my new rules and took a second one so my partialing size was correct. Then the price spiked down. My new rule is to definitely stop at B/E. I thought it was going to fly right through it so I exited a little early expecting a large slide. The slide didn’t happen and I caught the low. This immediately threw me and I honestly lost my cool. After two bad loss days I really needed a solid win and I knew by being stopped out on the penny the price was going to reach my target. Actually, the price rebound so fast I had no time to reenter the trade. And yes the price did promptly moved higher to my target.

My trading headed downhill from there. It’s too bad, now that I look at it, the AAPL trade was a REALLY good trade. I nailed the setup, the share size (which was tricky) and much better than usual on the trade management. And why get upset about the exit? I am switching to an auto B/E stop out (I won’t be able to thoroughly test it until tomorrow) so this early exit will be fixed soon. So I really should have kept my cool. But I didn’t.

I was definitely on the revenge rampage and saw the volume had arrived for BABA and I wanted to trade again fast. And I almost immediately got into another trade. Now the one good thing is actually this was a solid setup. So it is good that even when I start to lose it I am still taking OK setups.

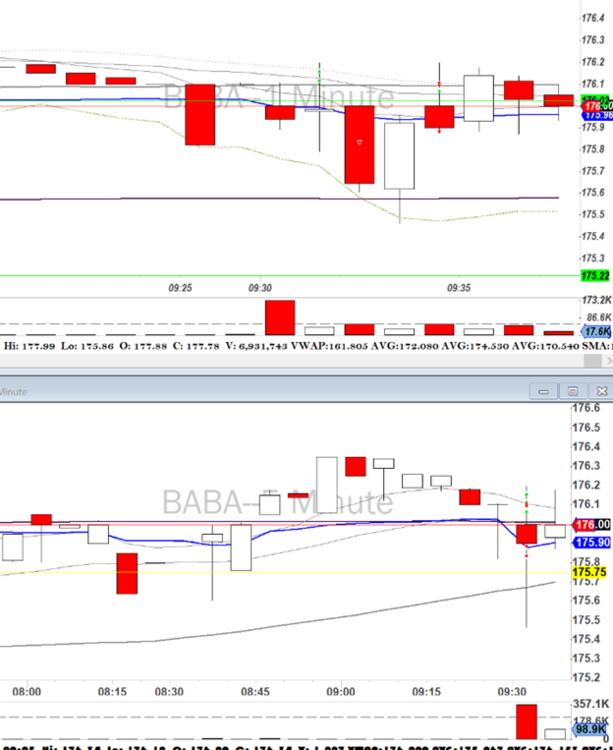

BABA had a powerful drop with high volume on the first candle. Then I waited for the bull back to short. I expected it to pull back to VWAP, but it found resistance at the PM level. I shorted at the bounce. Obviously I was not running on high quality focus at the time I took the share size without giving it the usual BABA slide. My target was the 168.02 level with VWAP as my stop. The price went against me immediately and I was stopped out.

Though I am allowed 3 trades/day now. I am not allowed to take a third trade after a full R loss let alone the last trade was a larger than -1R loss due to incorrect share size. But I am starting to lose it and I broke my rule and took a third trade again with BABA.

As I was about to get stopped out on my first BABA trade I noticed the really strong hammer being created on the 5min chart. I still have no real bias on BABA and the stock did gap up 2% in PM so long was possible. I tried to flip my position. My target was the HOTD with the PM level as my stop (yellow line on my chart below). Again I entered with the wrong share size (giving no thought to the usual BABA slide) and got a terrible fill. My is now R/R<1 and my risk is 2.5R. Thus I need to get out of the trade or at least cut my shares. This is something I have really been struggling with. I don’t seem to be able to do it. Especially on this trade which the price already started to go against me. So it looks like I was headed to a -3.5R loss for the day, which would be my first max loss day in 8 months (which I am really proud of). Which would be the end of a -7R three day losing streak as I head toward my 1 year trading live anniversary where I have to decide if I quit day trading. I was just about to really lose it when….

Then something surprising happen. I sold half my shares for a slight loss. Yes, fully exiting would be more correct, but this is a major breakthrough for me. I can’t remember when I at least partially exited out of a bad trade. I always just hold on until S/O. Which I did get stopped out shortly after.

About 4 minutes later BABA was getting squeezed into a pendant. I had no directional bias so I waited for the break. It broke lower so I shorted (in SIM). And I have no doubts that I could NOT have made this trade live. Even in SIM it is amazing I was so patient. I was just getting LL and LHs. So I kept waiting and took my first partial at 4R. Then exited the rest of my shares when it looked like it will reverse.

I labeled the trades 1,2,3 on the chart below since it is busier than my usual chart.

Score card (live trades).

AAPL

BABA

BABA

94%

88%

84%

What I did good today: My first trade was really good. I should have just chilled after the S/O.

What I am grateful from today? I was actually able to cut my shares in half after the bad fill on the third trade to reduce my risk to something acceptable. That’s a breakthrough for me. Right when I thought I may lose it. So I didn’t hit max loss. I live to trade another day.

What do I need to improve on: I broke the rules on taking a 3rd trade after a full -1R+ loss. So taking a third trade is off limits until further notice.

Since I had 3 bad trading loss days, I am restricting myself to one live trade a day until my discipline and emotional state gets better.

-

2

2

-

-

Live trading summary for week ending 9/27/19.

I already discussed analysis in my monthly so I will only discuss game plan for next week.

Back test data shows BABA and MU are still in play at the open. AAPL has become marginal. If you must trade AAPL do not trade standard 1min ORBs they have stopped working on AAPL. Only trade pull backs or hammers. Here is my plan for this week:

P/L will be closed and not looked at until the end of the month to help focus on process and score card, not on W% and P/L

MU and BABA both look good at the open. Try to look at both at the open. Keep a close eye on the volume with BABA. Wait for the 100k to arrive before entering a trade. Careful MU and BABA have very different personalities and setups. You must have them separate in your mind if you are looking at both stocks at the open.

AAPL is now marginal. If you must trade AAPL do not trade standard 1min ORBs they have stopped working on AAPL

Keep $30 risk per trade. Even though my score card allows me to increase to $42. I need to keep my risk more constant until I fix my partialling issues.

Remember to take an aggressive partial profit if the price reaches the target.

Try to exit at B/E after a 1st partial. Don’t look for the rebound.

Keep trading 5/10/15 min on SIM

Don’t add to any trade, even winners.

Continue with the Van Tharp’s Peak Performance Course for Traders.

Remember you can take a third trade in a day.

Try and take partial profits on the way down as well if you lose faith in the trade. Instead all out at B/E or exit too early.

You may take a live trade on a 5/10/15min ORB if you see a good setup.

Test new auto stop at B/E and auto limit order at 1.5R in SIM. When you feel comfortable with it, try it live.

-

Van Tharp Institute Peak Performance Course for Traders

Vol 3: How to Control Losing Attitudes

Chapter 3

A monster chapter. Huge exercises. I have been working on this chapter for almost a month and still not finished. I did just complete another exercise so I will post it now.

The idea of this you list 10 things that you try to avoid in your life. Then you order them in priority. Then for each item on your list you list 10 things explaining what you value about that essential need. So you end up with 100 words/phrases. Then you prioritize each under each category to have a prioritized list of a 100 values. Then for each of the 100 values you answer, “when do you know you have it and when do you know you don’t.” So you end up with 300 phrases. This took quite a bit of time.

Value to be avoided

How do you know when you have…?

How do you know when you DON'T have…?

Missing my kids grow up

Spending only 15 days/year with them

Little to no bond

My kids will spontaneously hold my hand

Every night I regret not spending more time with them that day

Go to sleep with regret

Fall asleep quickly

I will finally have time, when they are too old to care

They prefer spending time with their friends

They go out of their way to spend time with you

Realize it is too late to build the bond you wanted with your children

You try to bond with them but there is no foundation

The bond builds

Having to say no when they ask for you to spend time with them

Feel the guilt

They still ask, knowing there is a possibility you will say yes

Missing milestones

You see the milestones only on video

You are the one recording it

They prefer playing video games than spending time with you

You only see your kids behind an I-Pad or computer screen

They stop playing computer games to say hello to you when you come home

You lose touch of what their favorite things are

They surprise you when you think you are buying something they like

You know what they would like

They suddenly look taller

Self explanatory

You know what roller coasters they can ride on

They suddenly stop calling you daddy

You become dad

There is still a loving charm in their voice when they call you daddy

Sleep deprivation

Unsafe to drive

Fall a sleep at the wheel at least once a week

Chance of falling a sleep while driving never an issue

No energy

Very difficult to complete any task

Even have strength to exercise

No focus

Hours go by and you didn't accomplish anything

Feel like you accomplished a lot by the end of the day

Dizzy spells

Have to grab on to things especially after standing up

I can safely help tie my kids shoes

Catch colds easily

If anyone in my family has a cold I have it a couple of days later

I can safely take care of my sick family member without much concern

Procrastinate

Difficulty starting the task

Completing my to do list

Always irritable

Family keeps their distance

Able stay clear and calm

Way too much caffeine

4 double expressos, to keep going, is common

< 3 standard coffee/teas a day

Acid reflux from too much coffee

Need tums or food to reduce reflux, though I am not hungry

Not a concern

Fall asleep while standing

You never know when or where you may dose off

Not worried about falling a sleep during a meeting

Stress

Dread each day

Don't want to get out of bed

Spring out of bed in the morning

Unable to focus

Only think about what worries you

You can focus on the task at hand

Keeps you up at night

Wide awake at 3am even though your exhausted

Fall asleep immediately

Simple issues now look big

Always worried about something

Take life as it comes

Want to ignore difficult tasks/issues

Everything seems unsurmountable

Able to approach tasks

Inability to trade due to nerves

Take poor setups. Don't let winners run.

Patiently wait for setups

Always feel on guard

Can not relax

Feel safe

Heart pounds

Heart pounds to a point you are scared of your health

Breathing exercises is enough to clam yourself down

Different stresses are cumulative