-

Content Count

50 -

Joined

-

Last visited

Posts posted by daniel lindegren

-

-

A good stop loss is "if it goes against me this far, I may have been wrong about the direction".

Personally, I would have put it higher. There could have easily been another pull back and stopped you out, before breaking down through VWAP.

-

If you guys don't mind spending $160, you should definitely check out http://www.wasdkeyboards.com/. Their keyboards are awesome, and completely customizable.

-

2 hours ago, ejordan7 said:Thank you!

Have you ever placed the stop at the same time (with the same or an accompanying hot key)? Or do you just manually create that order in montage?

I never use hard stop losses, only mental. Having to manually create an order in the montage would make the keyboard and hotkeys obsolete.

-

2 hours ago, Peter S said:Thanks for the response. Exponential on both.

Comparing the price data on the two charts shows a high during 2013 on Tradestation of $547 and on DAS $180. I guess it probably comes down to how the data is/isn't adjusted - for splits, dividends etc. Whilst trading in this room I've been surprised at how effective the 200ma can be on the 1 minute chart - maybe there's greater agreement about what this price should be (although still with the complication of traders having the choice of using ema or sma).

We're using the 200 simple moving average. The only exponentials we use are the 9 and 20.

In my experience, the 200 is powerful on all time frames, whether it be 1min, 5min, or daily.

-

35 minutes ago, ejordan7 said:Can you provide some more detail how you set up hotkeys to always risk $100 based on what "alpha key" you press?

Thanks! Great idea!

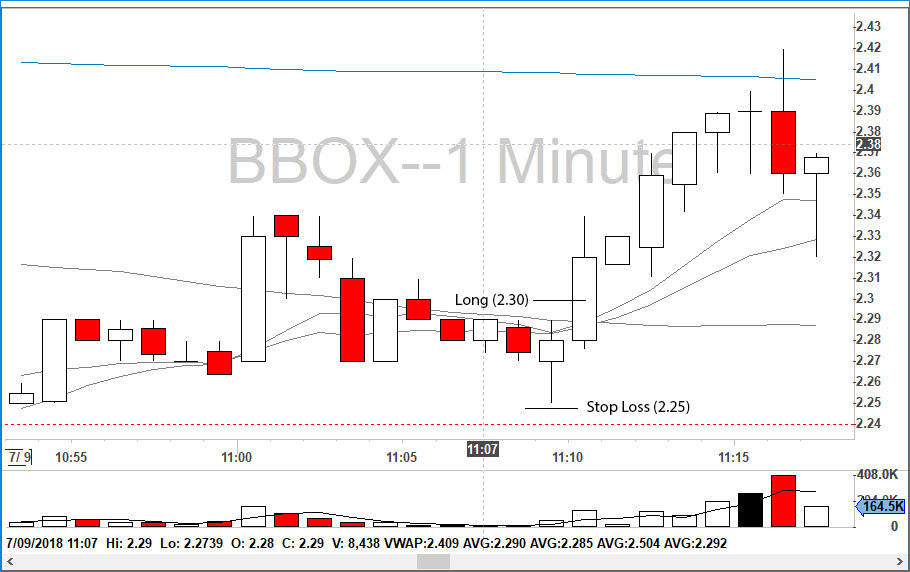

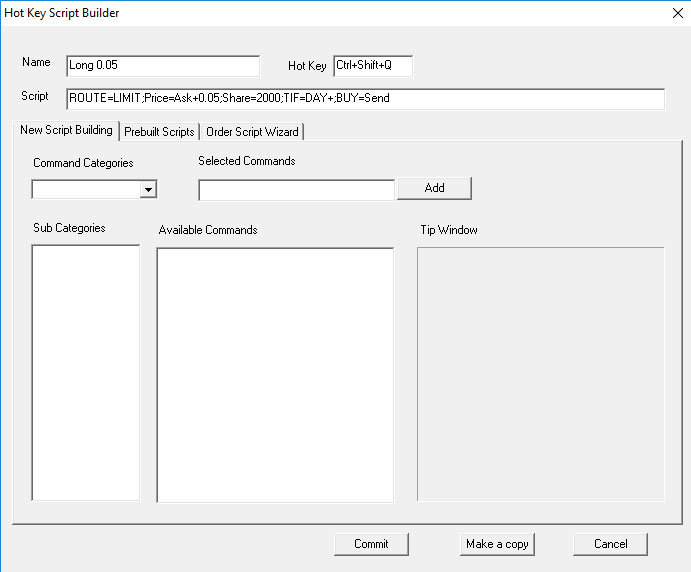

Please reference the image below.

If I were to go long at 2.30, my stop loss would be at 2.25. The distance from my entry to my stop loss is 0.05. I would press Long+Modifier+Q, as Q is 0.05 (2000 shares).

100 / .05 = 2000.

I also included an image of a hotkey example.

I hope this answers your question.

-

You're using 200 simple or exponential?

Regardless, when I was swing trading I would go back and forth between StockCharts and Think or Swim, and I would run into issues all the time with moving averages being in different places.

-

2 minutes ago, Aiman Almansoori said:Bro that's amazing, I loved the calculations and that sheet)) I printed it as well, I think I'll buy a keyboard and just stick everything bymyself for now, but I really like you keyboard :DD!! It's amazing! Thank you for sharing this)

Glad you like it. I hope it works well for you!

-

1

1

-

-

On 5/2/2018 at 7:31 AM, Shane said:I was wondering if anyone had any statistics/knowledge on determining when a short squeeze might be coming up? I find myself thinking about this more often at the end of the day but I'm sure any information would be useful at anytime.

Many times within the last hour I want to take a trade but the potential for a short squeeze/cover on a stock that dropped significantly or even a sell off on a stock that gained makes me hesitate.

I was wondering if anyone has any suggestions on how to determine when these two actions are more likely? Maybe some details on float, gain/loss, percentage short(for stocks that are down), and/or volatility?

Thanks in advance and look forward to you comments!

Here is a little bit of info: https://investorplace.com/2012/05/3-signs-of-a-potential-short-squeeze/

-

3 hours ago, planthevision said:I see Two different Speedtrader on the websites : Speedtrader and Speedtrader Pro , can anyone tell what is the difference?

Thanks

SpeedTrader Pro is with DAS (your trading platform).

-

I separated my personal expenses from business expenses by trading through an LLC.

Cash flow looks like this:

Speed trader (LLC) -> Bank (LLC) -> Bank (Personal)

I pay for all of my business expenses via Bank (LLC). Trading through an LLC also unlocks other benefits such as health insurance etc, but you have to file as an SCorp to do so.

-

On 5/25/2018 at 3:29 AM, Robert H said:Peter, very good points! Sometimes you have to trade a stock once to really know how it behaves. CPE is NYSE so that's the first red flag.

I keep a list of 'not tradeable', or choppy stocks in my memory bank. AMD, X, AA, etc. CPE just earned itself a spot.

Robert,

I believe I saw in another post that you use Tradervue as well? I started tagging NYSE stocks for this reason. An easy filter of the "NYSE" tag shows them all. Some of my biggest losers are NYSE stocks 😕

-

I highly recommend each of you get a paid consultation with Robert Green, as each one of your situations may vary slightly. I learned a lot speaking with him, and it was money well spent.

-

Does this help? From what I read, it looks like 4 is the max with that card.

-

1

1

-

-

I created this Google Spreadsheet to help myself with position sizing, and I thought I would share it with you guys. I always have this printed out and laying on my desk while I am trading. I did take this a step further and created a custom keyboard with hotkeys, but I will share that info at the end.

With this spreadsheet you are able to calculate your position size on the fly, just by knowing the distance to your stop loss. By default, the risk is set to 100. This means every single trade that you take, you should lose no more than $100. An example would be, if my stop loss is 0.30 away, my position size for that trade would be 334 shares.

You are able to change the default risk to what ever you are willing to risk, and your share sizes will automatically be calculated.

Here is the link: https://docs.google.com/spreadsheets/d/1iD0qiPLulbYSFri9r38SG1Ke7eNiZdFHNg8MldGwSng/edit?usp=sharing

To use this Spreadsheet:

- make sure you are logged in to your Google account, so you are able to copy the spreadsheet to your Google Drive

- go to File -> Make a copy... -> Then save it to your Google Drive

- Once you have copied the spreadsheet, you can now edit the default risk of 100, and your share sizes will be calculated accordingly

A step further... The Keyboard

Having this printed on your desk does help you easily calculate your position size, but it does have one drawback. You have to enter your position size in manually, which does eat up precious time. I wanted the idea of the chart used as hotkeys, so my solution was a custom keyboard. I have attached the proof I got back from http://www.wasdkeyboards.com, as well as a photo of the physical keyboard.

How it works

As you can see from the images, the distance to stop loss is printed on the alpha keys.

If I have my hotkeys set up to risk 100 per trade, Short+Modifier+E would short the stock with 667 shares:

- Risk: 100

- Distance to stop loss: 0.15

- 100 / .15 = 666.6 (667 rounded up)

Conclusion

Having the spreadsheet printed in front of me while I trade really helped with my position size. The keyboard really helped me execute my trades faster.

-

8

8

-

2

2

-

Are you at the level to be trading live yet? If not, I would suggest trading in your simulator until you're comfortable, and consistently green. Then, you can comfortably transition to your live account and take a little bit bigger position size so you can turn a profit.

-

TraderVue is amazing. Journaling my trades made me improve tremendously.

Is this a good stop loss?

in Day Trading Strategies

Posted

Look at your 5 minute chart. If it would have made a new 5 minute high, it would be safe to say that it's probably not going to go in your direction. Therefore, I would have put it closer to the high of the previous 5 minute candlestick (around 150.30 area). However, having your stop loss that high may change your risk to reward.