Lenny

-

Content Count

19 -

Joined

-

Last visited

Posts posted by Lenny

-

-

Dear all,

Curious to know about the following.

I have been a poker player for some time long in the past and something that was common in the poker communities was living together, and often in awesome places around the world. So let's say, for example, 4 individuals renting a place together in exotic places like Thailand or Costa Rica, or Australia to learn from each other by sharing strategies and speaking strategy all day. On the side a lot of fun is made, while having a great experience by living abroad.

Does anyone know if this is common in the tradings community, if people know about traders houses like this, or if there perhaps would be any interest for this?

-

Thank all of you, for your answers, very helpful.

To return to the question deciding a Macbook or a Windows laptop.

Will the trading software work as fine as well on the Macbook, or will the use of bootcamp, booting Windows from it's own partition, parellels, always have limitations with regard to speed etc. compared with a Windows laptop.

Or will a modern Macbook will work just as fine on all aspects as a Windows laptop with regards to using the trading software?

This because, only if the trading software will work just as fast, and comfortable on a Macbook as on a Windows laptop, I would prefer the Macbook because of my non-trading activities.

For now I have the luxury position, to be able to spend 1500-2k$ on a laptop -

Dear BBT community,

Hope you guys can help me out. I am looking for a good solution and I could use some help from all the experience over here.

I am getting deeper and deeper in daytrading. And I feel that is time to invest in good hardware, and a good setup.

So far have been trading so far on my Macbook from 2011 without additional screen. I am using the software “Parallells Desktop”. It works, but it is pretty slow to get it all started up (5 min), the parellels software takes a lot of memory from my laptop as well. But perhaps these are issues because my Macbook is old (from 2011). However, in general I prefer to use a Macbook for all the non-trading activities. I am open for a regular laptop though.

I prefer a laptop over a desktop, because i am always moving a lot, and preferable I am also looking to travel in the future, so I like to stay mobile with my trading setup.

1. So my first question would be, what your guys experience, or advise is, with regard to choosing a Macbook or not, for somebody that wants to gets more serious in to daytrading.

2. My second question would be, in general, what kind of laptop you guys would recommend, that works very well for daytrading.

3. Third, I was curious to know, what other hardware you guys would recommend me to buy, or to consider. Do you use certain keyboards, or mouses or certain screens?

Many thanks in advance,

Lenny

-

Hi All,

Looking to learn and therefor I am hoping for some feedback.

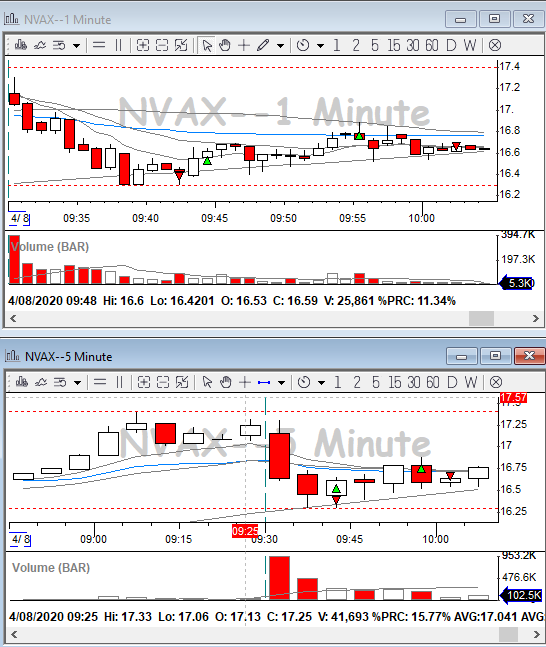

Stock gapped up in the pre marketFirst trade, I thought to have spotted some weakness even though the stock gapped up. I could get nice entry on the 1 minute on breaking that MA, and therefore I want in.

What are your thoughts?

Second trade. I could get a nice entry on the 1 minute on what seemed to be a potential break of the VWAP. A bit later the pattern seemed weak and therefor I stopped out.

What are your thoughts on this entry?

What are your thoughts on me stopping out? perhaps I should have waited untill I have hitted my hard stop loss on 16,45?

-

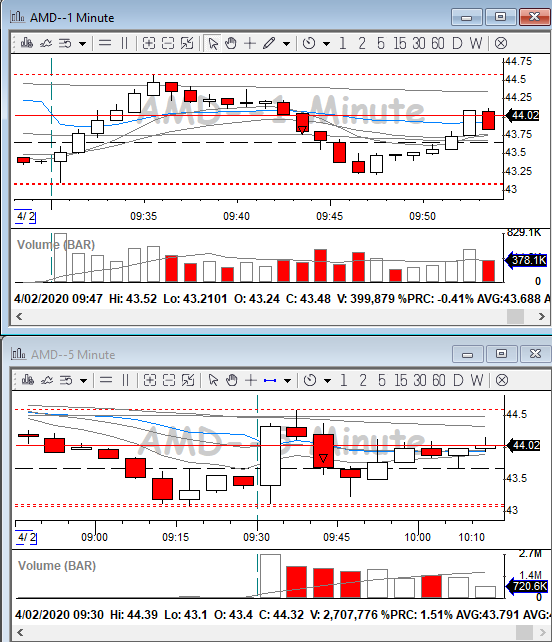

Hello All,

AMD was in play and at the moment of trading only 0,3% up or something i believe, so not a crazy move. We broke the VWAP and were below the moving averages and there was space to move below.- What do you think about this trade?

- What would be other factors to consider here?

Many thanks.L.

-

Hello community,

WBA was in play today, there was potential of movement and we were above the moving averages. The pattern gave me the idea that there was strength. Do you agree?

- What are your thoughts on it?

-

Hi All,

Zoom had some bad news with regards to privacy/data. Seemed to be very weak.

I thought it was a nice moment to enter for a reverse ABCD. It was on SSL, therefore I had to put two limit orders and therefore my order got filled in two times.- What do you guys think on this trade?

- Should I have waited for more confirmation before entering the trade?

- What would be other factors that you guys would consider before entering this trade?

-

Dear all,

My question is with regard to my second trade at 09:47. Uber was already down around 8% for the day.

How would you rate this trade or what would you considerations be?

-

Dear all,

CCL was already 10% down, but still seemed to be very weak. What do you guys think of this short?

-

Dear community,

Had MU on my watchlist, stocked gap up, but appeared to be weak. It gave me the appearance of a wedge/descending triangle. So I entered a short position (Papertrading)

1. What are your thoughts, and what should I have thought about the long wicks on the 5th and 6th candlestick on the 5 minute?

2. Do you like the entry?

3. What would have been your stoploss point and where would you have started to take profit?

-

Hello team BBT,

In this trade I wanted to take the ride down, but got stopped out. Trade was on March 20 and stock gapped up. (papertrading)

1. Because of the long wick after the first 5 min candle I didnt want to take the ORB down. Is this a good reasoning?2. On the 5 min, the stock already had quite some distance from VWAP. Was is therefore to late to take the trade, or not?

3. What are other factors to consider here or how to improve myself?

-

Hello guys,

This is a paper trading account, still first week papertradingThis was yesterday, March 20. Stocked gapped up, in the premarket it was showing some weakness. I decided to take the ORB break down, but got squuezed out I guess, within 2 seconds the stock was 2 USD higher.

Was it a good trade and good entry, and/or what other considerations should I have taken before taking this ORB breakdown?

Many thanks and kind regards,

-

1

1

-

-

Dear BBT,

First week papertrading.

Apologies for the basic questions I am asking, but I feel that , learning now when I am just starting could send me way faster in the right direction.

Even though they were two winning trades. I feel like I was a bit weak in my reasoning to enter. Stocks were definitely in play, we were above the moving averages, and both stocks at the seemed to be strong,What factors would you consider before entering here?

-

Hi All,

First week papertrading.

Looking forward to hear your thoughts, how would you approach this situation, and how I need to change and add to my thinking.

ZM, looked in my judgement, based on the chart, strong today. There also seemed to be no resistance levels above.I put the stop 50 cent below and wanted to take profit 1 USD up.

My first trade got stopped out

My second trade got stopped out

My third trade got stopped out

My fourth trade was a succes

My fifth and sixtth trade I got stopped out again

1. Was my stop loss too tight?

2. What would be other considerations before entering this position, or what factors could I consider to make a more accurate entry?

3. Can it ever be okay to keep on trying to catch the wave up if you get stopped out?

Many thanks,

L.

-

Thank you guys

-

1

1

-

-

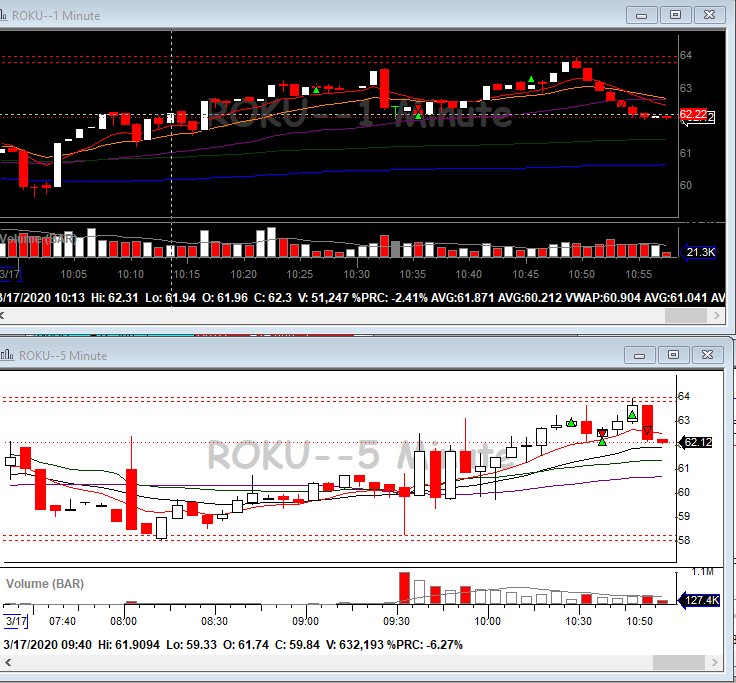

Dear all,

This is a papertrading account and I just started trading.I would like to have your thoughts on the two trades I made. I think I know what I did wrong ( a lot went wrong), but curious to know if you will give the confirmation or will show me something else that I did not see.

There is a fat finger mistake in the chart. Instead of selling everything of my first trade (stop out) I added to position. After this add, (while I wanted to sell) I immediately sold everything at once at 10:35.

This was Roku yesterday (March 17th)

I mainly focussed on the 5 min chart here,As you can see Roku was in a uptrend, and there were, at least untill 70 USD no resistance levels above, we were above all the moving averages so there seemed to be the potential to go up. My R:R would be 1:2. In both trades I placed the stop 75 cents below with a first profit target of 1.50 higher.

Question 1. Should I have waited first if we had the confirmation that we broke through the level of the highest wick of around 09:50/09:55?

Question 2. Should I have waited for the confirmation of an increase of volume in the entry (or confirmation?) candle?

Question 3: What would be other factors to consider?

Kind regards,

-

Any Europeans?

in Members Introductions & Meetups

Posted

Hey All,

Dutch / European, living in Amsterdam, here. Would be great to discuss strategy, psychology and markets together. Just let me know if anyone knows a group or would like to get in touch.

Lenny