Stuart

-

Content Count

47 -

Joined

-

Last visited

-

Days Won

3

Posts posted by Stuart

-

-

Brendon, I was just wondering about you the other day! Glad your back man! My story is much the same, but over-trading was and will be my biggest demon. Best trading to you!

-

Norm,

Thanks for setting this up! I'm excited to meet with other BBT members and Andrew in person. What can I do to help with the Austin meetup?

Thanks again,

Stuart

-

I agree, adding DAS risk controls to the competition might keeps things more equal.

-

On 3/22/2019 at 11:35 PM, hailchaser2 said:Friday 3-22

Only made one plan before the open.

I did not wait the 3 minutes like my rule states before trading, I traded on the first candle.

Trade 1 Shorted, then added to position, took profits on reversal.

Trade 2 Long, took profits, then final at break even

Trade 3 Short, could have held for more profits, but decent trade.

P&L

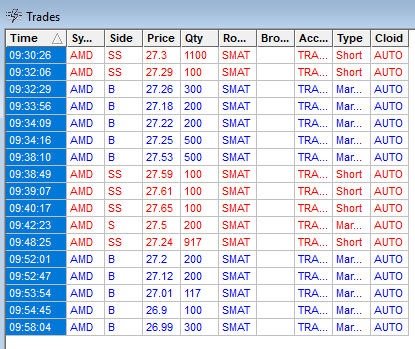

Trades

Hand written journal entries

Nice journal work. I like the "If/Then" thought process!

On 3/22/2019 at 11:35 PM, hailchaser2 said:Friday 3-22

Only made one plan before the open.

I did not wait the 3 minutes like my rule states before trading, I traded on the first candle.

Trade 1 Shorted, then added to position, took profits on reversal.

Trade 2 Long, took profits, then final at break even

Trade 3 Short, could have held for more profits, but decent trade.

P&L

Trades

Hand written journal entries

Nice Journal. I like the "If/Then" thought process.

-

1

1

-

-

At least they have decent coffee at Love's! (Not sure how the beer selection is). lol

Good luck at the new base.

Stuart

-

1

1

-

-

Bobby,

I'm using the snipit tool on my pc and can edit/mark with that. There's also a free app https://epic-pen.com that I have used that a lot of people here use. Not sure if it's Mac friendly though.

Have a good one,

Stuart

-

1

1

-

-

Nas'

Just saw this post. I checked the prices on the three stocks you mentioned Nov 13, and it would have been a nice win if even shares were applied to all three. BBBY+1.31, NTLA-4.82, BECN+6.63. (according to finviz this morning) 312 bucks on a 5963 investment given 100 shares on each stock. Better than 5% as of today! (I think my math is correct). I really liked your strategy on these. Do you think you would have held the swing that long? I've held a lot longer on trades and done a lot worse. lol!

Great post!

Regards,

Stuart

-

1

1

-

-

Sounds good, I look forward to meeting our central Texas traders!

-

1

1

-

-

Are we going to meetup today?

-

I could make that time and day. Sounds great!

-

Wednesdays are best for me. Around noon would be better on traffic for me. Thanks!

-

Domian sounds great!

-

Would love to join you

-

I will go to the DFW meetup

Thanks!

-

I'm in! The weekend works best for my schedule. Thanks Norm!!!

-

I can drive up from Round Rock, and would like to meet with you all!

Thanks!

Stuart K

-

Aiman,

Thanks for the reply! Yes it's different than the mornings for sure! I will be training the mornings when I can get time off from work. I will be careful at the last hour!

Thanks again,

Stuart

-

So I have been limited to trading the hours of 2-4 pm EST in the first month of sim. I call them the "Sour Hours" based on the looks on Brian P's , and Andrew Aziz's faces when posed the question on strategies for these hours in the mentor-ship forum. lol

I had a couple of green days this week, and on Friday I used a simple strategy of looking at the overall trend of the stock from the open, and going with that direction. It worked 2 of 3 trades that day, and I wondered if this thought process seemed valid. I traded stocks from Andrew's watch list in this way, and put a range stop on them so I could step away and not stare at it. I took profit too early, and could have been more patient with my winners, but I was good at being impatient with my losers. I don't know if anyone else in the BBT chat is in a similar situation with trading hours, but if you are, come join me as a "Sour Hour Trader"!

Thanks to all of you at BBT!,

Stuart K

-

Abiel,

Mine failed after a week. Green power light not on. I checked cables and monitor ect and still not working. Returning for refund, but I see a lot of good feedback here. Is yours still working?

Thanks!

Stuart K

-

Thanks Carlos! I just downloaded it.

Best Regards,

Stuart

St. Louis, MO BBT Meetup: October 19th, 2019

in Members Introductions & Meetups

Posted

What a great time in St. Louis and meetup with some Bear Bull Traders! A BIG "Thank you" to Kurt and William for making this meetup so very special! We had new traders, swing traders, and long time traders to bounce our thoughts and questions off of. And of course many thanks to Andrew who supported all of this! I would highly recommend attending a BBT Meetup as a way to find out how our other traders approach Day Trading and get to know some of the greatest members of our BBT community.

St Louis has a lot to offer as a visitor, and I was lucky enough to get out for a little sight-seeing.

Thanks to everyone that came out! (It was a bit chilly without my jacket the next morning.)