Brandon Comer

-

Content Count

4 -

Joined

-

Last visited

-

Days Won

1

Posts posted by Brandon Comer

-

-

Wednesday, August 15, 2018

12:02 AM

Points for Trading Journal

1. Your physical Well-being (Lack of sleep, too much coffee, to much food the night before, etc.) I had 7 hours of sleep two cups of coffee.

2. The time of the day you made the trade: I Traded From 9:35am until 2:07pm.

3. The strategy you were anticipating.

4. How you found the opportunity (from scanner, a chatroom, etc.) All Opportunities were found with Scanners, the Nasdaq Website and finvis.com

5. Quality of your entry (risk /reward)

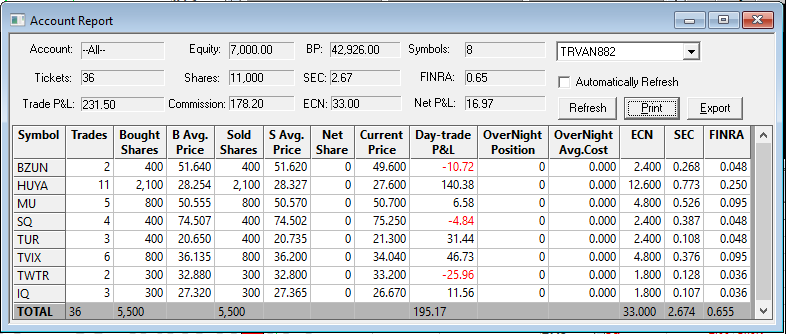

6. Sizing/ Management of your trade (scaling in and out as planned) -36 Tickets

7. Execution of exits (following profit targets or stop losses)

· HUYA- Went long Huya at 29.17 thinking it was going to be an opening range break up, however I did not realize the bearish candle before the bullish candle stick, the Trade ended up going short, I go stopped out at 28.35 for big loss.

· I then went short at 28.21 and once I noticed it was going towards the low of the day, and I covered at 28.04, 27.85 and stopped myself at 27.93.

· I then went long on at 28.54 when I thought the stock was trending higher, The stock went down on me, I held on to the stock and then sold at 28.59 and 28.60.

· I then went long again with at 27.98, when I noticed it was in the middle of a reversal, my price Target was the VWAP, I rode it to the Vwap and sold all at the 28.26.

· +140.00

· BZUN- I went short Bzun at 51.62, I was trying to ride the opening Range Breakdown to the low of the day, however I got "chickened out" and sold early at 51.64 for a 8 dollar loss.

· -8 dollars.

· IQ- I went long IQ at 27.32 and sold at 27.40 and 27.33, I did not know what I was doing with IQ I just jumped in the trade.

· +13.50

· MU - I went short Mu at 50.46, I noticed it was still breaking down below the Vwap, I had a level at 50.14, which was my target, Due to the Volatility of MU, got chickened out and again sold early at 50.58.

· I then went long mu at 50.53 , when I noticed it did reversal, I sold some at Vwap 50.62 and then sold the rest at 50.74.

· +60.00

· SQ- I went long SQ at 74.58, when I noticed I was above the WVAP and the it tested the 9 moving average a few times, my target level was 74.91 which was the high of the day, I sold at break even after I notices the stock was turning.

· I then went short at 74.27 and sold at 74.29 when I noticed the stock did no lose the VWAP.

· -2.00

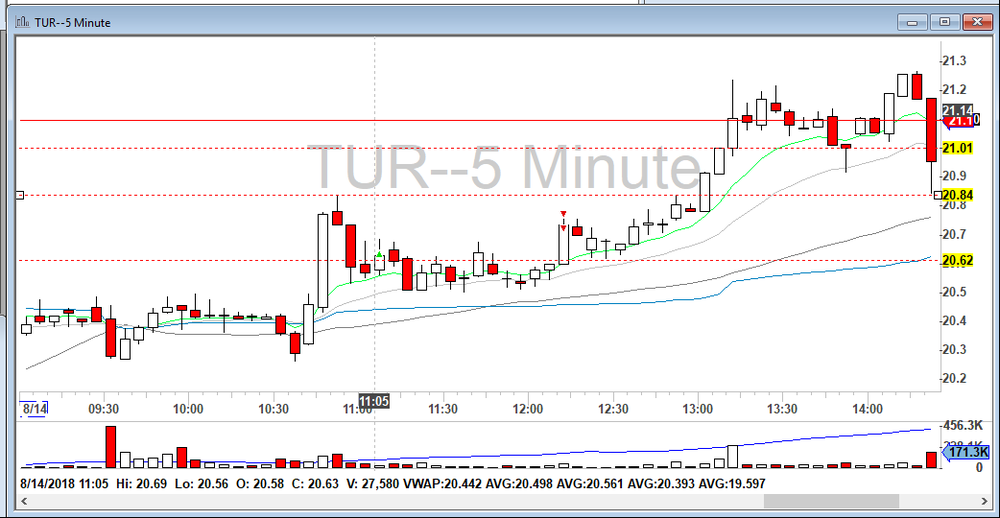

· TUR- went long TUR at 20.65Once I Realized it was above the VWAP, my target was a level at 20.84, the stock ended up going down and held the Stocks and then sold them at 20.76 and 20.71

· +34.00

· TVIX- I went short TVIX at 36.88, once I saw the stock had reached the high of the day, and it was going down to test the VWAP, my target was the VWAP, I got chickened out and covered at the 9 moving Average at 36.82,36.63 and 36.57

· I then went Short again at 35.52, once I saw it was below all of the moving averages, I did not have a level at the bottom, so I did not have a target so I stopped out at 35.56, when it went up.

· +52.00

· TWTR- Bought Twitter thinking it was starting to reverse at 32.88 and got stopped out at 32.80

· -24.00

Final Recap- I did not think I traded well today, I did a lot of over trading, with 36 tickets, I'm still struggling with finding the patterns. I need to work on identifying my price targets and the patterns I am trading. I am also working on identifying stocks in play and taking the right share sizes. My biggest issues is also knowing risk reward and know when to stop myself out. Even, though I was positive today I do not feel like, I was positive.

-

3

3

-

-

Mon, July 30, 2018 -452.30

Monday, July 30, 2018

8:04 PM

Points for Trading Journal

1. Your physical Well-being (Lack of sleep, too much coffee, to much food the night before, etc.) I had five hours of sleep( Not enough sleep) two cups of coffee had to go to rest room during trading.

2. The time of the day you made the trade: I Traded From 9:35am until 3pm.

3. The strategy you were anticipating.

4. How you found the opportunity (from scanner, a chatroom, etc.)

5. Quality of your entry (risk /reward)

6. Sizing/ Management of your trade (scaling in and out as planned) -63 Tickets

7. Execution of exits (following profit targets or stop losses)

Twitter- At 9:35 I went Short on for the opening range Breakdown at 33.20 @500, I begin covering Shares at 33.00, 33.80., 32.60. For a nice Gain. I then went Long 32.75, (thinking it was going to reverse,) I got stopped out and sold all of the shares at 32.40.( I have to work on managing better Risk reward) I then went long again @32.70 thinking it was going to go up and Test the VWAP, however it went down, I sold all the shares at About 32.50. The last trade I made was a revenge Trade, I went short about 32.45 and covered about 32.40 and 32.35.

Facebook- I cannot Explain my Trading of Facebook today.

AMD- At about 11am Saw the stock was Trending Down and Went short 19.72 (600 Shares), I immediately sold at about 19.65, when I thought the stock was going to reverse on me. I then took another trade to the short Side at about 1:50pm, I went short at about 19.80 and sold the shares at about 19.72 once I saw the candle trending upwards (600 Shares).

MU- I did not know what I was doing with MU today, overtraded, did not have a plan.

SSLJ- At, 1030 Am I went long at 2.43, thinking the trade was going to continue to trend up, ( Now that I look at it, I caught the Trend at the top of the Reversal Bad Entry) I got Stopped out at about 2.35. I then went long again at about 11:45am At about 2.36, I held on to the Shares until about 12:35 and sold the shares at about 2.34. Then Went short again, thinking that the Stock would follow the VWAP however when the Stock was finally at VWAP, I lost Internet Connection and I was not able to Sell it at 1:20pm. I then decided to hold on to it until it goes back down but decided to sell when it reached the high of the Day( I now realized that was a mistake and I should have sold as soon as I got internet connection. An hour after I sold my positions, it dropped below the VWAP.

Sent from Mail for Windows 10

-

Thursday August 2nd 2018- + 58.52

Thursday, August 2, 2018

7:10 PM

Points for Trading Journal

1. Your physical Well-being (Lack of sleep, too much coffee, to much food the night before, etc.) I had 6 hours of sleep( Not enough sleep) one cup of coffee

2. The time of the day you made the trade: I Traded From 9:35am until 11:53am.

3. The strategy you were anticipating.

4. How you found the opportunity (from scanner, a chatroom, etc.)

5. Quality of your entry (risk /reward)

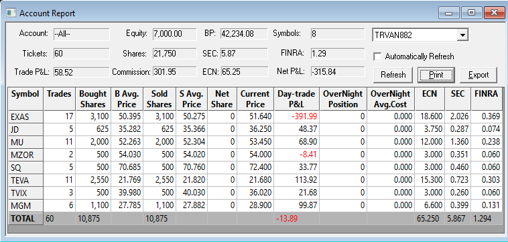

6. Sizing/ Management of your trade (scaling in and out as planned) -60 Tickets

7. Execution of exits (following profit targets or stop losses)

TVIX- I went long after the Opening Range Breakdown, 39.98, thinking the stock was going to continue to go up, once It hit 40.10 , sold some then I stopped out at 39.96, once I saw it was reversing.( I did not have a goal to where I wanted to go.) +25.00

EXIS- I went Short on EXAS at 50.53, at the opening Range Break down , I then covered on the way down at 50.37 and then got out at 50.25, when I saw the bullish candle.

· I then went short again at 49.85, thinking it was going to continue to trend down it popped up on me and I bought at 51.25.

· I then went Long at 51.31, thinking it was going to continue the up trend , when I realized it was not going to continue to trend up, I sold at 51.37, 51.34

· I then went short again at 50.65 I covered at 50.29,50.13 and stopped myself out at 50.27

· I then went short again, at 49.86 and when it went higher instead of stopping out, I went short again at 50.70 for 100 more shares. I then stopped out at 50.01 for a small loss.

· I then went short again at 49.32 and stopped out at 49.32 once I saw it was trending up.

( I realized, I overtraded, averaged down and Revenge Traded this stock, I broke a ton of rules which is not good) -393

MU- I went long at 52.06, when I noted the stock trending up then I sold at 52.09 and 52.12. ( I did not have a goal Price goal)

· I then went Short at 52.15 and covered at 52.08 and 52.13 ( I did not have a price goal)

· I then went short at 52.44 and was stopped out at 52.43

· I then went short on 52.52 and covered at 52.47 and 52.44.

(I realized, I over traded this as well, I'm having trouble identifying my price goals along with levels) -

+68.90

JD- I went long at 35.25, I was looking for the reversal sold half at 35.33, I believe a made a key Stroke Error and bought shares at 35.41 and sold at 35.41 and the rest at 35.37.

+48.37

MZOR- I went short at 54.02 thinking the stock was going to continue to trend down and was stopped out at 54.03 when the stock squeezed me out.( I realized, I need to give myself a better stop Point and not at my entry)-5.00

SQ-I went short at 70.76 thinking the stock was going to continue to trend down, I covered half at 70.70, 70.43 and then I stopped out at 70.85. +33.77

TEVA - I went Short Teva at 22.33 after noticing the chart is trending down, I covered half at 22.19 and was stopped out at 22.35

· I then went short again at 22.11 and covered half at 21.97,21.89 and 21.88

· I then went short again at 21.31 and covered at 21.56

· I then Went long at 21.56 and sold at 21.57, I believe this was a key stroke Error. +113.00

MGM-I Ent Long at the opening range Break up at 27.78 and sold at 27.96 and 27.89

· I then went short at 27.83 I was thinking that the stock was in the middle of the reversal, however the reversal was over so I covered half at 27.78 and 27.80 +99.87

Sent from Mail for Windows 10

Trade Journal For Brandon Big B

in Day Trading Journals

Posted