-

Content Count

292 -

Joined

-

Last visited

-

Days Won

21

Posts posted by Bailey Nevener

-

-

Notice how GreekTrade didn't stick around, despite the "confused" reaction to my post. Hmmmm.......

-

On 9/27/2021 at 7:48 AM, cindyishh said:Thank you for sharing! I love this visual table. One thing I'm struggling with now with a small cash account is waiting for the cash to settle so I can trade again. How did you manage trading with this?

Also trading long At the money Put or Call options with the nearest expiration date in a cash account allows the cash to settle overnight. Therefore you can trade everyday.

Just make sure you pay attention to elevated levels of Implied Volatility if you ever Buy to Open anything out of the money. That can really cause problems for some of these stocks in play as the day drags on. Not to mention you will be fighting theta which is a real problem with the closest day expiration. It works well (in terms of controlling risk) in scalping.

On top of that, make sure that the underlying stock has elevated volume because the spreads can get crazy on options. On any given day you should be able to trade a high volume tech stock or a sector ETF with no issue. If you trade a sector ETF, be extra careful, the leverage even at the money is insane. However the spread is extremely small!

-

I'm having a substantially easier time working with the current margin requirements. So much so, that I actually have updated this table to reflect more accurate numbers.

Year $ Gain Risk Bump +10% Intervals Risk Per Trade 0.05% Goal Amount 5R Weekly Amount Monthly Amount $ 46,328$ 25,000 $ 25 $ 125 $ 625 $ 2,500 $ 27,500 $ 28 $ 138 $ 688 $ 2,750 $ 30,250 $ 30 $ 151 $ 756 $ 3,025 $ 33,275 $ 33 $ 166 $ 832 $ 3,328 $ 36,603 $ 37 $ 183 $ 915 $ 3,660 $ 40,263 $ 40 $ 201 $ 1,007 $ 4,026 $ 44,289 $ 44 $ 221 $ 1,107 $ 4,429 $ 48,718 $ 49 $ 244 $ 1,218 $ 4,872 $ 53,590 $ 54 $ 268 $ 1,340 $ 5,359 $ 58,949 $ 59 $ 295 $ 1,474 $ 5,895 $ 64,844 $ 65 $ 324 $ 1,621 $ 6,484 $ 71,328 $ 71 $ 357 $ 1,783 $ 7,133 $ 145,397$ 78,461 $ 78 $ 392 $ 1,962 $ 7,846 $ 86,307 $ 86 $ 432 $ 2,158 $ 8,631 $ 94,937 $ 95 $ 475 $ 2,373 $ 9,494 $ 104,431 $ 104 $ 522 $ 2,611 $ 10,443 $ 114,874 $ 115 $ 574 $ 2,872 $ 11,487 $ 126,362 $ 126 $ 632 $ 3,159 $ 12,636 $ 138,998 $ 139 $ 695 $ 3,475 $ 13,900 $ 152,898 $ 153 $ 764 $ 3,822 $ 15,290 $ 168,187 $ 168 $ 841 $ 4,205 $ 16,819 $ 185,006 $ 185 $ 925 $ 4,625 $ 18,501 $ 203,507 $ 204 $ 1,018 $ 5,088 $ 20,351 $ 223,858 $ 224 $ 1,119 $ 5,596 $ 22,386 $ 456,318$ 246,243 $ 246 $ 1,231 $ 6,156 $ 24,624 $ 270,868 $ 271 $ 1,354 $ 6,772 $ 27,087 $ 297,954 $ 298 $ 1,490 $ 7,449 $ 29,795 $ 327,750 $ 328 $ 1,639 $ 8,194 $ 32,775 $ 360,525 $ 361 $ 1,803 $ 9,013 $ 36,052 $ 396,577 $ 397 $ 1,983 $ 9,914 $ 39,658 $ 436,235 $ 436 $ 2,181 $ 10,906 $ 43,624 $ 479,859 $ 480 $ 2,399 $ 11,996 $ 47,986 $ 527,844 $ 528 $ 2,639 $ 13,196 $ 52,784 $ 580,629 $ 581 $ 2,903 $ 14,516 $ 58,063 $ 638,692 $ 639 $ 3,193 $ 15,967 $ 63,869 $ 702,561 $ 703 $ 3,513 $ 17,564 $ 70,256 $ 1,432,120$ 772,817 $ 773 $ 3,864 $ 19,320 $ 77,282 $ 850,099 $ 850 $ 4,250 $ 21,252 $ 85,010 $ 935,109 $ 935 $ 4,676 $ 23,378 $ 93,511 $ 1,028,619 $ 1,029 $ 5,143 $ 25,715 $ 102,862 $ 1,131,481 $ 1,131 $ 5,657 $ 28,287 $ 113,148 $ 1,244,630 $ 1,245 $ 6,223 $ 31,116 $ 124,463 $ 1,369,092 $ 1,369 $ 6,845 $ 34,227 $ 136,909 $ 1,506,002 $ 1,506 $ 7,530 $ 37,650 $ 150,600 $ 1,656,602 $ 1,657 $ 8,283 $ 41,415 $ 165,660 $ 1,822,262 $ 1,822 $ 9,111 $ 45,557 $ 182,226 $ 2,004,488 $ 2,004 $ 10,022 $ 50,112 $ 200,449 $ 2,204,937 $ 2,205 $ 11,025 $ 55,123 $ 220,494 $ 4,494,606$ 2,425,431 $ 2,425 $ 12,127 $ 60,636 $ 242,543 $ 2,667,974 $ 2,668 $ 13,340 $ 66,699 $ 266,797 $ 2,934,771 $ 2,935 $ 14,674 $ 73,369 $ 293,477 $ 3,228,248 $ 3,228 $ 16,141 $ 80,706 $ 322,825 $ 3,551,073 $ 3,551 $ 17,755 $ 88,777 $ 355,107 $ 3,906,181 $ 3,906 $ 19,531 $ 97,655 $ 390,618 $ 4,296,799 $ 4,297 $ 21,484 $ 107,420 $ 429,680 $ 4,726,479 $ 4,726 $ 23,632 $ 118,162 $ 472,648 $ 5,199,126 $ 5,199 $ 25,996 $ 129,978 $ 519,913 $ 5,719,039 $ 5,719 $ 28,595 $ 142,976 $ 571,904 $ 6,290,943 $ 6,291 $ 31,455 $ 157,274 $ 629,094 $ 6,920,037 $ 6,920 $ 34,600 $ 173,001 $ 692,004 -

1

1

-

-

Anytime I am shorting options, I am doing an OTM credit spread about 45 days out behind a support or resistance on the daily.

This maximizes the theta decay from one day to the next increasing your rate of receiving max profit. You should cut it around 21 days if you are close to max profit or roll it forward to keep the decay rate high if it is still a good trade.

Since this is so many days out, I would only do daily chart entries or higher. The profit from these takes a little time, but that is a huge edge from the theta decay.

Enter for mid-term trade ideas. Was there an earnings overreaction? If the price drops into a support level, initiate a spread with the strikes well below the bottom of that support, and as the Implied Volatility dries up you will immediately be in the money.

-

1

1

-

-

It is possible for certain, but if that is your mindset rather than “How can I become a good trader?” you probably won’t last.

Smart people that are dedicated make a living from this.

If you are asking a forum on whether or not you can do it, you probably aren’t either.

You can always change that though.

-

Yes. By putting your money into an S-Corp and paying yourself as an employee and cashing out only what you need to live. Also if you can successfully have Trader Tax Status you can count your losses as regular losses rather than being capped at 3,000 that rolls over every year. I’m sure there’s more, but I’m not sure of what else off of the top of my head.

-

@GreekTrade If the chat room isn’t mainly a distraction, you probably don’t have a strategy, or can’t follow it.

-

1

1

-

-

One screen for DAS, and maybe one screen for screeners and the chat room. However, info overload definitely will kill progress and create horrible habits. I think you might find, like many others, even having the chat room up is too much. Especially at first.

-

2

2

-

1

1

-

-

If I had to guess they are manually adding them premarket.

-

On 1/11/2022 at 8:29 PM, Silviu said:One more questions: What if the gap is bigger than the ATR, but the stock moves in a direction that reduces the gap. For example, what if in the example you showed above the stock would set up for an opening range break up, instead of bread down? Would you take that trade? Or do you take the trade (at least for ORB) only in the direction of the gap (so downwards in the example above)?

Yes I would and have.

However since you are more than likely countertrend trading (due to trading against the gap) be careful with placing your stop too close because there will likely be whipsaw price action before it moves in your direction.

Also, build a tradebook on that type of scenario over time because it will behave differently than a 60 minute breakout in the direction of trend. (One of the precautions I have mentioned)

-

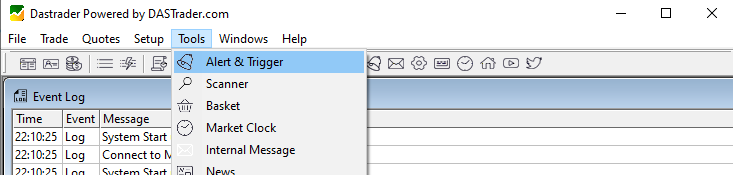

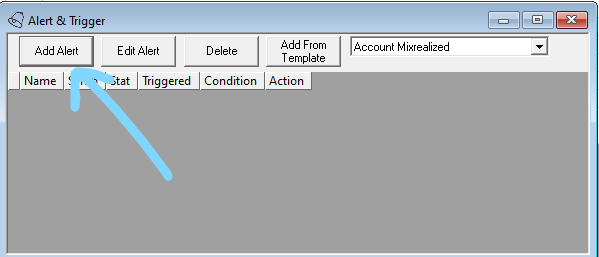

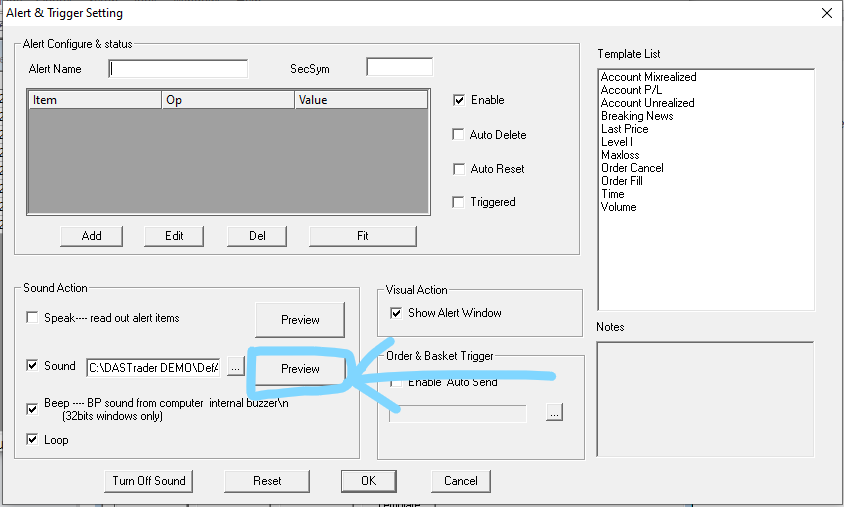

A lot of times this beep noise is from alert notifications.

The notification may be hidden behind a top layer window when it appears, so you don't actually see it when it appears.

Thus it just seems like a random beeping noise.

Why would the window be coming up at all?

Most likely you are hitting Max Loss with the risk controls or you have set up a price alert.

Follow these windows and click on the final "Preview" button, odds are that is the noise you are hearing.

I have my risk control page completely blocked off as you already know, but there is an option to disable hearing the noise if you stop out.

Enjoy!

-

I have looked into this a little bit.

The most common assumption as to why someone would use a specific route is because there could be an increase of execution speed on a trade.

However, unless you are trading low volume OTC stocks or something like that, I am not sure that a custom selected route would outpace the SMRTL algorithm provided by IBKR.

There is definitely a benefit in regards to share volume though!

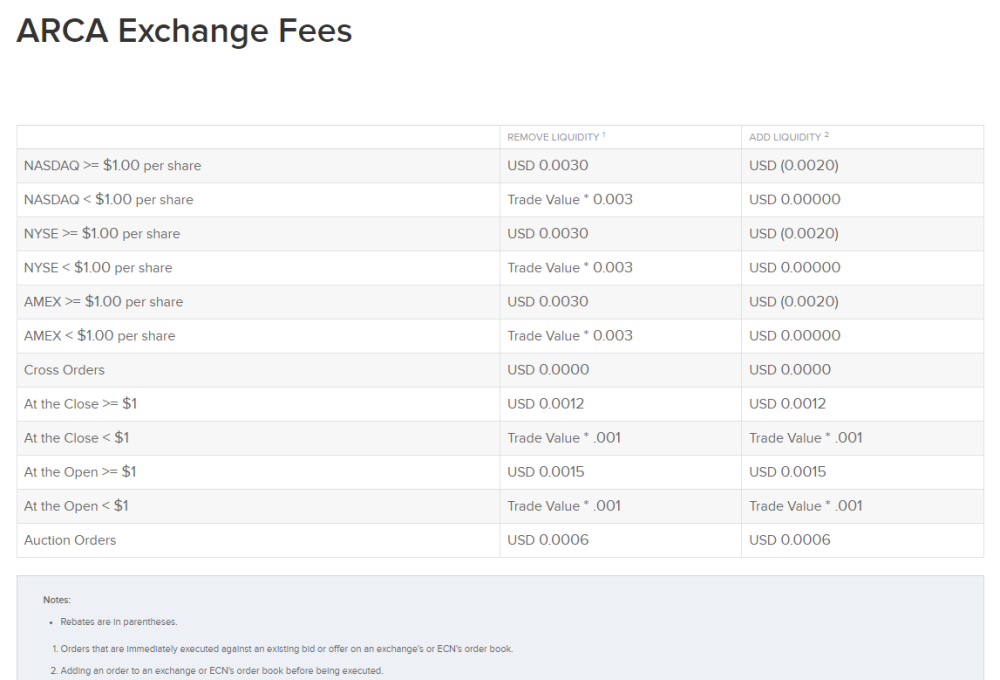

If you scroll down to the "US Exchanges" heading and click on the ARCA link for example, it will open up a window that looks like this:

If you add liquidity (by placing a limit order that isn't automatically executed) you will be compensated monetarily via rebates from the exchange you are executed on.

In this case, if you were trading stocks that are normally traded on BBT, you would be compensated $2 per 1000 shares of liquidity you add on both NASDAQ, NYSE, and AMEX stocks.

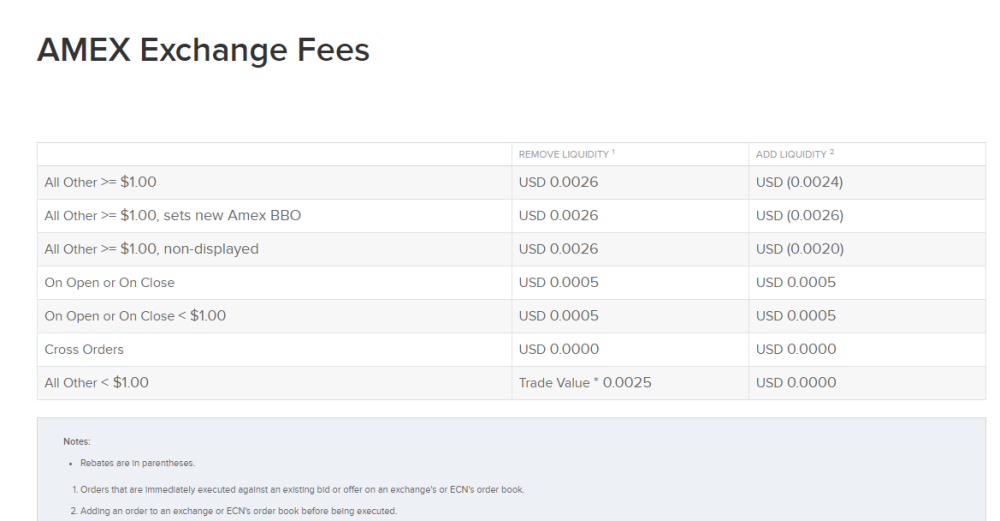

Here's the one for the AMEX route:

As you can see, AMEX will pay an extra $0.40 per thousand shares over what ARCA will pay for adding liquidity.

Unfortunately this is one of the easiest comparisons of exchanges of the bunch listed, but you get the idea.

DAS has a short manual on how to add a particular route to your montage here.

It is worth noting that this was only written in regards to the tiered commission structure, I don't know how being on the fixed commission structure affects it.

Let me know what route you ended up choosing for the maximum rebate because I may just change my "Sell on Ask" / "Cover on Bid" hotkeys to it!

And could you like my post so my reputation points can stop being 69? Lol.

Enjoy!

-

1

1

-

1

1

-

-

I have day traded on a laptop for several years, but the only thing I can really speak on is the screen space.

In my opinion you might want a little bit bigger screen space than that especially when you are not sure what your strategy is yet.

You will likely need at least 3 different time frames on screen, time and sales, account windows, and level 2.

Unless you are going to be sitting extremely close to your screen, you may have an issue fitting it all comfortably without something a little bigger.

That is my 2 cents.

-

Fortunately IB does indeed support autostop.

-

Yes. I don't think he wanted to be cornered into options.

-

On 10/5/2021 at 6:42 AM, _cameaton said:Have you grown these account with swing trading or options? If both, how much of each? How long did you paper trade before you tried growing these accounts?

All of my accounts were mainly grown with swing trading. Significant advances were made through a few day trades with large R:R as well.

I was on-and-off trading for about 3 years (but consistently listening / watching lectures about it) due to being in the Navy and going on deployments the whole duration.

After I got out of the Navy, I had a solid 6 months to myself, and during that period I became consistently profitable.

The first of the accounts I grew was on the tail end of my time in the Navy, and the remaining two have been considerably easier to make now that I am no longer in that environment.

It is also worth noting that I don't use DAS when my account is under 25k.

-

On 9/27/2021 at 6:48 AM, cindyishh said:Thank you for sharing! I love this visual table. One thing I'm struggling with now with a small cash account is waiting for the cash to settle so I can trade again. How did you manage trading with this?

Essentially I was investing in companies I knew that would do well initially.

Anytime that an extremely obvious day trading opportunity happened, I would liquidate my investment position, increase my account balance, and then reinsert my funds into the investment.

The purpose of the investment is to keep yourself relatively mentally involved with trading by feeling like you are 'doing something'. This is key because you need to really only be taking high probability ever-so-often trades with a catalyst.

There were often weeks at a time where I would not take a trade, but each time I did, I substantially increased my account balance.

This was one of my best risk-to-reward trades I've ever had. I was -$50 premarket at the largest drawdown. I had many days similar to this.

I would only trade if a catalyst pulled me to the market, rather than trying to trade and looking for a catalyst.

This is just how I did it. It helped me make big trades, avoid PDT, and finally get over $25k with stability.

I was definitely not perfect with this approach, but you have to find out what works for you.

-

It is extremely important to do the math (as you are doing) and actively acknowledge the logical barriers to your success.

In short, you will either need to risk more per trade, lower your commissions substantially, or get a larger account so you can risk a lesser percentage per trade and overcome commissions.

Those that say that commissions should not be considered often are parroting successful traders with huge accounts. Those successful traders that say commissions are not a factor often did not start with a small account (sub $5,000) to build up their current account.The logical way I see it, is to move your account to a commission from broker like TD Ameritrade and swing trade or invest to $25,000. Or at the very least to $5,000 for CMEG.

It’s not as hard as you may think. The investing route is easier in my opinion. (with regular, small deposits) With a few high probability ace-in-the-hole swing trades that come along every couple weeks you will build up a comparably sizeable account.

Just do your research on the company(s) you invest in. I’ve made two small accounts go the distance to $25,000 so far. This will probably be my last time doing so.

The two separate times I made it there was with a $5,000 account and a $3,000 account. (Although once I got the $5k account up to $25,000 I blew it up horrifically with a YOLO options trade) Both of the accounts took a couple months to get there fortunately, but I was psychologically willing in both cases to wait 2+ years.

Once I paid off my high interest debt with the $3,000 account, (turned into $37k) I started my current one with $8,000 and am about to get this third one over $25k in the next couple months.

The reason I paid off the debt was specifically because it was high interest, and I had big life expenses at the same time that needed attention. Had I been able to keep it, I would be well over $60k by now with the same account only 4 or 5 months later. Oh well lol, won't ever have that problem again.

The current one I'm on is at $18,000 after about 8 months,(starting from $8,000) but I was much less aggressive with this account because I am tired from the psychological "freak out" I had to pay off my old debt. Maybe I would have already made it to $25,000 if I had been really aggressive, but for me at this point it’s just not worth the stress. No debt? No rush.

The hard route that a lot of people recommend is to become amazing at trading with a small account, harness your iron will, (while you have no money) and use 3 day trades on a rolling schedule in a pure cash account using options or something similar with a margin stock trading account.

In my opinion this is substantially harder and frankly, slower, since blowing up or getting locked out 90 days before hitting $25k is almost inevitable. Aiman did this apparently, and I also did this for the first half of my $3k account. But I feel that this was an unnecessary complication for me and an exercise of Aiman’s brilliance.

Anyone who says that you should chop it out and pay tuition to the market in the form of learning is masochistic, psychopathic, or unprofitable, but most importantly, they are not thinking about what they are saying, so they are first and foremost, unreasonable. Life is hard enough without knee jerk advice that can affect the outcome of your future.

-

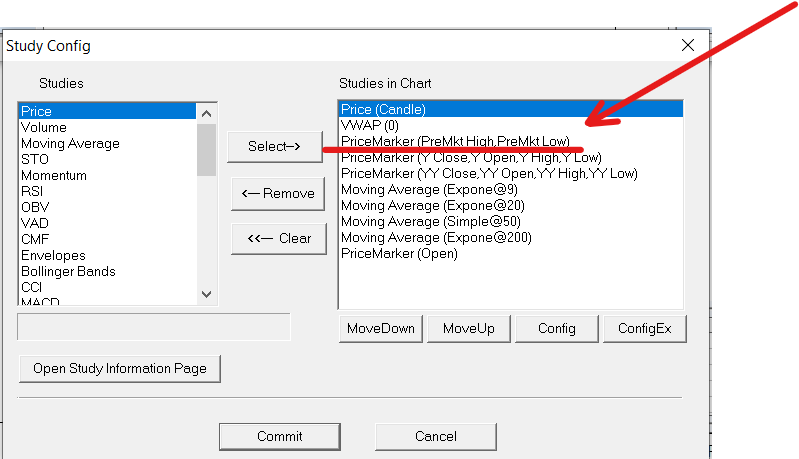

Hi Paul,

I might have to split your question up:

If premarket high is a higher price than the high after the market open, which one is the "high of day"?

The high of day is the highest price after the market open. If premarket high is a higher price, it is still just "premarket high", NOT high of day.

Should I plot premarket high/low?

Yes, and better yet you can have DAS automatically plot those levels for you.

Right click a Chart > Study Config > select a PriceMarker indicator > Configure to display PreMktHigh and PreMktLow.

You can do the same thing for High of Day and Low of Day as well,

but make sure your make the line style different from daily levels

otherwise you might accidentally think that the high of day bounced off of a daily level when there isn't actually a resistance there etc...

-

1

1

-

-

This is stating that if you select a particular route rather than allowing TD Ameritrade’s smart routing algorithm to decide the fastest route for execution, that you may end up selecting a slower route than the best route currently available.

Therefore they are informing you that the route you have chosen might not be the best out of all of the routes and might take longer to execute than all of the available routes.

Going direct to the market maker is the fastest, but that is assuming that you have selected the best market maker at that time you placed your order.

Now the question I also have now is, is there a difference between using TD Ameritrade's algorithm and having direct access?

I have a feeling that is yes, but I don't know for sure.

-

1

1

-

-

In the period where you aren't consistently profitable, I would suggest staying away from the "avoiding criteria" as you called it.

Specifically I am suggesting reducing the amount of requirements to enter a trade. It is a bad idea to draw almost any conclusions when you are starting out. It is better to just foster an environment where you feel like you can follow the rules that you have set for yourself, no matter how basic they are.

This is an example of a no-assumptions trading plan:

Find a 60 minute range break candidate. (Why you are looking at the stock)

Enter at the 60 minute range break with your stop below the nearest technical level. (How you are managing risk)

Let the trade go to 2:1 and take 90% of the position. (Giving yourself a reason to exit)

Hold onto the last 10% to 4:1 or get stopped out at your original stop or breakeven. (Allowing yourself to become more experienced with the price action)

This breakdown is meant to be changed, but only after you "just can't take it anymore".

Let the data change your strategy, and keep it as simple as possible until that happens.

Good luck hombre.

-

In terms of "hedging" it only really makes sense if you are betting on two supposedly correlated symbols.

AKA longing one symbol and shorting a different symbol to reduce exposure to market conditions.

That is, to get beta as close as possible to 0 and make money on the basis of an individual stock's move separate from the overall market.

One thing that you technically would be hedging against I suppose is the slippage when you are exiting the entire position.

However, the commissions and fees associated with opening up another position likely will outweigh that difference unless you are entering positions with a rebate and exiting with a rebate.

Maybe it would actually end up helping in that way if I actually did the math, but I'm not sure.

On 9/7/2021 at 3:19 PM, tamago168 said:Loss is limited and potential gain is enormous.

Also as a finish it is important to understand that this is incorrect.

The loss is unlimited in this net-short scenario and the potential gain is the net-short shares you are holding multiplied by the stock price.

It's more straight forward "hedge" like this with options.

(You aren't hedging, your net-short scenario essentially is a short equal to 30% of whatever your short position size is, since it was "offset" by the 70% long position)

For example, you could open a long CALL with a short shares position.

The long CALL gives you a limited loss on the shares.

-

I use it, but you definitely don't need it.

In my opinion it is less important the higher the timeframe that you are trading on.

-

I got you Gator.

Fortunately I do what you are asking all the time.

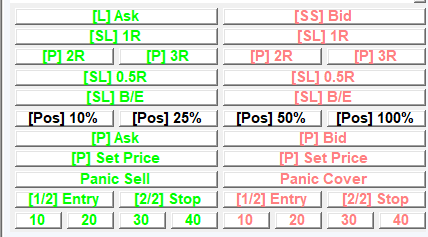

Here's my hotbutton layout for reference, but what you are asking only needs pieces of it.

There are 3 Steps to do what you require:

1) I enter the trade with a double click at my desired stop price, and then I click either of these hotbuttons.

2) If I want to take a partial at a specific price I first specify what % I want to take off of my current position with these.

3) I then double click where I want to take said partial on the chart and click either of these.

Here's the hotbutton scripts associated with each step:

1)

[L] Ask: StopPrice=Price-0.01;DefShare=BP*0.97;Price=Ask-Price+0.01;SShare=50/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=LIMIT;Price= Ask+0.05;TIF=DAY+;BUY=Send;

[SS] Bid: StopPrice=Price+0.01;DefShare=BP*0.97;Price=Price-Bid+0.01;SShare=50/Price;Share=DefShare-SShare;DefShare=DefShare+SShare;SShare=Share;Sshare=DefShare-SShare;Share=0.5*SShare;TogSShare;ROUTE=LIMIT;Price= Bid-0.05;TIF=DAY+;SELL=Send;

2)

[Pos] 10%: Share=Pos * 0.10;

Etcetera...

3)

[P] Set Price (Green): ROUTE=LIMIT; TIF=DAY+; SSHARE=0 ;SELL=Send;

[P] Set Price (Red): ROUTE=LIMIT; TIF=DAY+; SSHARE=0 ; BUY=Send;

See you in chat fella.

-

2

2

-

Risk Control Page (DAS Trader Pro)

in DAS Trader Pro Tips and Tricks

Posted · Edited by Bailey Nevener

@RealEstateDayTrader

I use the Total Loss parameter because it is what actually what "stops you out" with the auto-stop feature.

I set the Max Loss parameter about a 1/2R below my true "Max Loss".

I do this because in the event that I lose 4.5R's due to commission, it would be unwise to take another 1R trade even though I haven't hit my true "Max Loss" yet.

So it makes it where I have certain days that I basically hit max loss, but it is just underneath my actual Max Loss.

Due to the slight delay in the auto-stop feature (using only the Total Loss) and slippage, sometimes my "Max Loss days" would be a full 1R beyond my true Max Loss.

Generally that would occur when I took a final trade that was a 1/2R or less away from my Max Loss.

Also Max Loss is not supported on an individual ticker basis, it is based on the whole account.